In comments that sound eerily similar to a warning issued by Putin, who warned during a speech last month that the US risked undermining the dollar's reserve currency status with its sanctions regime, the CEO of the world's largest asset-management firm said Tuesday during a panel discussion at the New Economic Forum in Singapore that the US dollar's status as the world's dominant currency wouldn't last forever.

And instead of citing external factors like China's expanding economic clout and influence, or an insurgent Russia, Fink pointed to the widening US budget deficit as the biggest risk to the dollar's status as the global hegemon. And while it might not happen tomorrow, or next year, over time, as US interest rates rise and the federal government strains under its tremendous debt burden, the creditors who were once eager to buy up Treasury bonds will gradually disappear.

"We're going to move there over time" Fink said.Instead of working with its creditors like China, the US is fighting them by engaging in an acrimonious trade war. Fink said that, in his experience, it's never wise to fight with your lenders.

"The problem is we are living with a deficit that is very large. We are fighting with our creditors right now worldwide," Fink said.And as interest rates rise and the government struggles with its newfound debt premium, collateral damage in the equity market will be almost inevitable.

"Generally, when you fight with your banker, it's not a good outcome," he said.

"I wouldn't recommend you fight with your lenders, and we're fighting with our lenders. Forty percent of the U.S. deficit is funded by external factors. No other country has that."

The US will have a "supply problem" as the widening deficit requires more borrowing. The threat of "interest rates becoming too high to sustain the economy with its growth rates" is becoming a real concern for the US.

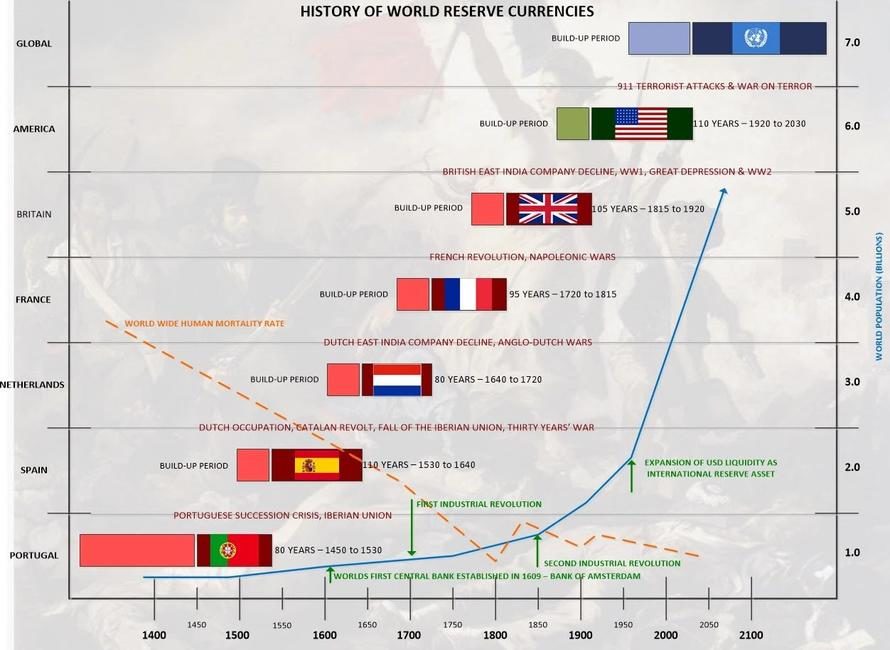

"We are going to have more and more debt because of the deficits, and because of the deficits, the investors are going to demand a bigger premium," he said. "We have greater risk for higher rates and will not allow the equity markets to flourish."If history is any guide, the US dollar's dominance of the global financial system is already looking a little late in the cycle. In the past, reserve currencies have reigned for roughly 100 years. The US dollar has dominated for about 80 years.

"There are some great needs in society right now," Fink said. "And a $1.3 trillion deficit as the economy slows down is a real problem."

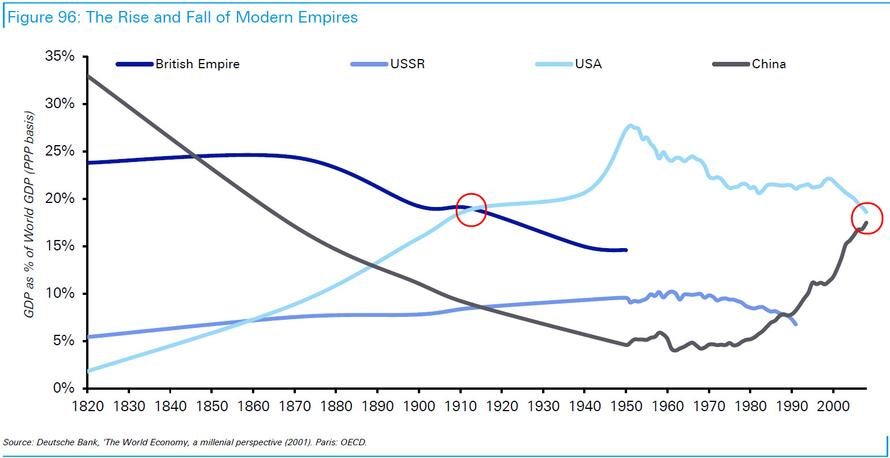

But for anybody who has followed our coverage of the growing mutiny against the dollar, the structural problems with the US national debt aren't the only threat. Just as the dollar emerged to global reserve currency status as its economic might grew, so the chart below suggests the increasing push for de-dollarization across the 'rest of the isolated world' may be a smart bet...

Of course, the decline of the dollar could be a good thing...for the rest of the world. According to former World Bank Chief Economist Justin Yifu "the dominance of the greenback is the root cause of global financial and economic crises."

Yifu's solution was to replace the dollar and all other national currencies with one global currency. But already, Putin and Chinese President Xi Jinping are working on a different solution of their own.

Comment: The writing's on the wall for the dollar, as well as the US empire; the only question is when.