Indeed, it's an incredibly powerful club. According to Oxfam, a leading poverty-fighting organization, eight men own as much wealth as the 3.6 billion people who make up for the poorest in the world, and one in ten people survive on less than $2 per day. Still, the top 1% consists of a lot more than just eight people.

This raises an interesting question: Who exactly are the 1%? The surprising answer: If you're an American, you don't have to even be close to being uber-rich to make the list.

Ranking by Income

According to the Global Rich List, a website that brings awareness to worldwide income disparities, an income of $32,400 a year will allow you to make the cut. $32,400 amounts to roughly:

- 30,250 Euros

- 2 million Indian rupees, or

- 223,000 Chinese yuan

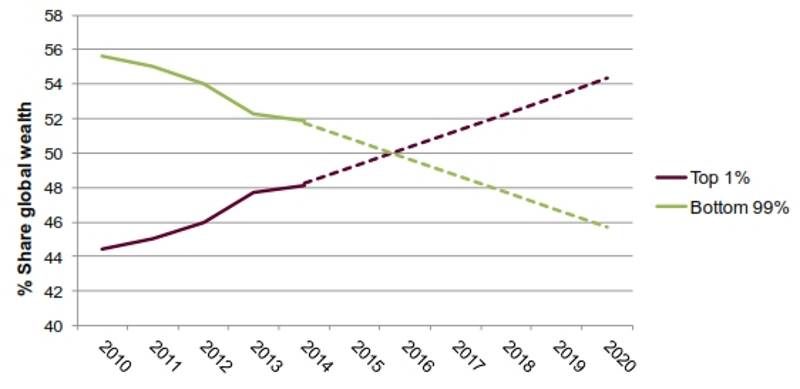

Figure 1. The percentage of global wealth owned by the top 1% was on pace to surpass 50% by 2016.

Ranking by Wealth

The threshold is significantly higher if you look at the top percentile by wealth instead of income. To reach that status, you'd have to possess $770,000 in net worth, which includes everything from the equity in your home to the value of your investments. That's equal to roughly:

- 720,000 Euros

- 49.8 million Indian rupees or

- 5.3 million Chinese yuan

There are a number of reasons for this disparity. One is that U.S. consumers tend to rely on credit more than their counterparts in, say, Europe. Credit card debt diminishes net wealth. The typical U.S. household carries a whopping $134,643 in debt, according to the most recent Census Bureau data.

Even so, many middle-class Americans who have spent years paying down their mortgages and saving for retirement belong to the upper echelon of the world's wealthy.

Pervasiveness of Poverty

The bar to enter the top 1% wouldn't be this low were it not for the extreme poverty that so much of the globe endures. For example, an adult in India has a median wealth of $608 in total wealth, according to a report by Credit Suisse. The average wealth of adults in Africa is even lower at just $411.

Compare that to the wealth of $49,460 for the average adult living in North America and $11,319 for Europeans. Now, the median wealth represents what most people have, the average will be much higher especially in countries where assets are so skewed toward the ultra-rich, like the United States. The average wealth of the U.S. wealthy is $344,692 per adult - this shows how much the few on top have, not just in the U.S., but globally.

Making 1% Ranks in U.S.

Who constitutes the 1% if you just look at the U.S.? Not surprisingly, it takes a massively higher income to crack the top percentile of wage earners: You'd have to make $450,000 in adjusted gross income (AGI) to make the cut.

And to rank amongst the highest 1% of Americans by wealth? That requires net assets of more than $7 million, based on the latest Federal Reserve figures.

The Bottom Line

The term "top 1%" of global income may sound like an exclusive club, but it's one to which millions of Americans belong. It's a reminder of just how prosperous developed countries are compared to the vast majority of other people who share our planet.

Comment: If the income of an individual doesn't allow them to live where they are in dignity, it doesn't matter how prosperous the country is as a whole.