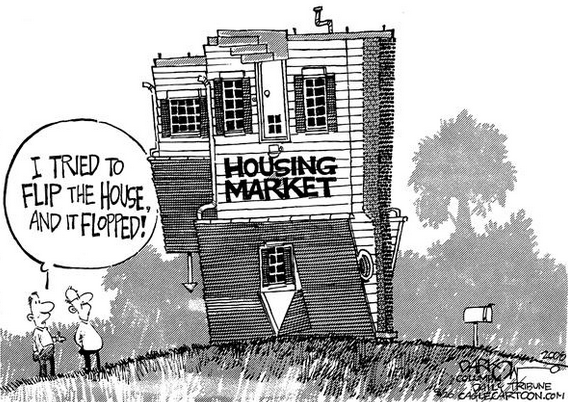

As Bloomberg reports, million-dollar homes in the U.S. are selling at double their historical average while middle-class property demand stumbles, showing that the housing recovery is mirroring America's wealth divide.

Purchases costing $1 million or more rose 7.8 percent in March from a year earlier, according to data released last week by the National Association of Realtors. Transactions for $250,000 or less, which represent almost two-thirds of the market, plunged 12 percent in the period as house hunters found few available homes in that price range.And here's the thinking that is driving that...

...

"The real estate market is the ultimate reflection of confidence, wealth and income," said Sam Khater, deputy chief economist at Irvine, California-based CoreLogic Inc. "The same factors driving the income stagnation in the middle are driving the income momentum at the top."

Gary Wasserman, CEO of Troy, Michigan-based Allied Metals Corp., is considering selling two homes in Florida -- one in Naples and another in Miami Beach -- to take advantage of rising prices in the area. He's also buying a 5,000-square-foot (465-square-meter) condominium in a project under construction in Miami's Coconut Grove section.But it isn't all shits and giggles in reality... as U.S. home prices climbed 12.9% in the year through February and wages rose only for the top U.S. earners and fell for the bottom 90 percent,

...

"The stock market is very strong and this is a way to monetize and concretize some gains," said Wasserman, 64. "We had quite a shock to our collective confidence in 2008 and 2009. The resurgence of the economy has underscored for us that this country remains a very strong place and that the future remains strong."

"With the mortgage headwinds and the lack of job growth and everything else that we dealt with through this housing cycle and now into the recovery, the typical first-time buyer got kneecapped," Jeff Mezger, CEO of the Los Angeles-based company, said on a conference call in March. "So there is no demand there, and we found a way to go flex up and change product and move as quickly as we could to where the demand was."The bottom line is that unless you made a fortune in unrealized wealth in stocks over the past few years, you are now priced out of buying a home... and even those with gains are 'rotating' into the real estate market lifting the dream further away and on more and more fragile stilts...

...

"First-time homebuyers are paying retail price, investors are getting wholesale pricing,"

...

"The American Dream is dead for everybody but the happy few who have enjoyed the tailwinds of the appreciating stock market," said Robbert van Batenburg, director of market strategy at New York-based Newedge, a multi-asset broker-dealer that published a note to clients last month on the unequal housing recovery. "On the low end, home sales are still making fresh lows every single month."

Reader Comments

to our Newsletter