A

recent Pew Research report shows that the American middle class is disappearing. Most Americans are no longer considered middle class anymore. The wealth gap in this country, a gap that continues to grow, has already broken all records. In short, the rich are getting richer and the poor are getting poorer.

Data also shows that, despite the fact that many American college students enter their adult lives by taking on tens (and sometimes hundreds) of thousands of dollars in debt for the promise of a good job with better wages when they graduate,

in reality, they are starting out making barely more than the average college graduate made nearly 40 years ago.

Male/female pay gap aside, in 1979, the average male college graduate started his new job at $20.61 an hour.

In 2011 according to this chart, that wage averaged $21.68, just a few cents over a whole dollar more. In 2014, the amount only increased to $21.86 (and 2015 data isn't out yet, obviously).

But what does that 2014 dollar really buy these days? Because the price of everything has gone up a lot more than a dollar.

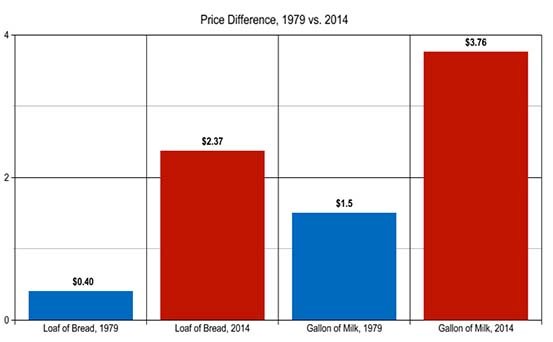

Let's just look at the differences between the two years in the price of a loaf of bread and a gallon of milk.

© Inthe70s.com, NationMaster

So a college graduate, starting out his adult life as a debt slave, might make a whole $1.25 more an hour these days, but a loaf of bread costs nearly $2 more than it did in 1979, and milk is $2.26 a gallon now. Go ahead and figure this up for everything the average person buys in order to get by in daily life and... well...

You get the idea. Inflation has increased 244.24% since 1979.

And all this, despite the fact that in 2008 it was reported that college tuition fees have increased in the U.S.

a whopping 439% since 1982!

Unless a person has rich parents who pay for college, taking out loans is about the only way most college students can even afford college.

Over 70% of Americans have some sort of student loan debt, which now exceeds total credit card debt in this country. The average student loan debt is $33,000. The student loan debt bubble has grown to over $1.3 trillion in this country. It's one of the main reasons more college students and graduates than ever

are still living at home with their parents.

And the reality is, the jobs for grads just aren't there.

This study is one of many which shows that the growth of supply of college-educated labor is exceeding the growth in labor market demand for college-educated labor.

The jobs simply are not awaiting all these college graduates, as evidenced in this chart here:

Twice as many people (or more!) are looking for jobs in most sectors than there are jobs available in those sectors in this country.

And currently 48% — that's nearly

half — of America's college graduates are working jobs that

do not even require their college degree. The proportion of overeducated workers has grown substantially since the 1970s; according to the Bureau of Labor Statistics, some 5 million American college grads are working jobs that require

less than a high school education.

So why are so many young people still taking on gargantuan amounts of student loan debt just to pay thousands more a semester to get a college degree for a job that either doesn't exist or ultimately isn't going to even help them pay all that student loan debt back, let alone be able to afford the basic necessities to live on?

Hope.That's the only reason I can figure. The promise of the American Dream. It's a dream because the reality is, it simply does not exist.

And in other news, long-term unemployment in America is now at an all time high...

Comment: A college degree in the US is worth less and less. Compared to a traditional degree, one from YouTube University may be money and time better spent .