The November 2012 proposal, as reported last week, would raise an estimated $7 billion annually over five years.

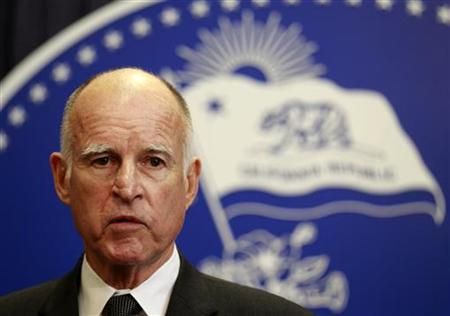

"The stark truth is that without new tax revenues, we will have no other choice but to make deeper and more damaging cuts to schools, universities, public safety and our courts," Brown wrote in what he dubbed "An Open Letter to the People of California."

The broadest tax hike is the half-cent increase in the state sales tax. Based on Bee research, it would amount to a $123 annual increase for the median California joint tax filer earning $65,025.

The income tax hike would apply to individuals earning at least $250,000 and joint filers earning at least $500,000 by imposing three new marginal tax brackets.

For example, under current law an individual making $750,000 would pay the state 9.3 percent of taxable earnings above $48,029.

Under Brown's proposal, that same individual would pay 10.3 percent of income between $250,000 and $300,000; 10.8 percent of income between $300,000 and $500,000; and 11.3 percent of income above $500,000.

The income tax hike would be retroactive to January 2012, while the sales tax would increase Jan. 1, 2013. Both would expire at the end of 2016. A copy of the initiative is here.

The Democratic governor blamed Republicans for blocking a similar tax vote this year. He said Democrats "went ahead and enacted massive cuts and the first honest on-time budget in a decade." But absent higher taxes, he said the state could not eliminate its ongoing deficit problems.

Besides generating new money, the initiative locks in a shift of existing sales and vehicle taxes for services transferred to local governments, such as housing some inmates and overseeing parolees.

The governor says in his letter that the new revenues will "be spent only on education," seemingly a nod to polling data showing that voters may be willing to support taxes for public schools (emphasis is Brown's).

But unlike a competing measure proposed by wealthy civil rights attorney Molly Munger, the Brown initiative allows the $7 billion to count toward the state's existing constitutional requirement for school funding. While true that the $7 billion would only pay for schools, the initiative frees up general fund money that can go toward a variety of other state programs, such as corrections, universities or social services.

Go for it Jerry! And while you're at it, slap hefty taxes on the profits of the major "too big to fail" banks.