As part of its effort to stimulate the economy, the U.S. government issued stimulus checks to millions of employed Americans. Where did the money coming from? The government had to borrow by selling its debt in the form of U.S. Treasury bonds and other types of securities. The after the bonds are sold, the Federal Reserve gets to work and starts printing money.

But money printing is not new. The Federal Reserve has printing money to pay for about $29 trillion in U.S. debt. However, what's new is that the 40% of US dollars in existence were printed in the last 12 months alone.

What is so ironic about this number is that just two years ago, Federal Reserve reported that 40% of Americans don't have $400 in the bank for emergency expenses, according to a report from ABC News. The 2019 Federal Reserve survey finds that almost 40% of American adults wouldn't be able to cover a $400 emergency with cash, savings, or a credit card charge that they could quickly pay off.

The US government has been printing massive amounts of new money. On January 6, 2020, the US Federal Reserve had around $4 trillion dollars. On January 4, 2021, the number increased to $6.7 trillion dollars. Money is usually a medium of change to facilitate the sale, purchase, or trade of goods between buyers and sellers. However, since there is no productivity (good and services) to back up the trillions of dollars currently in circulation, printing more money doesn't necessarily increase the economic output (productivity), it only increases the amount of money circulating in the economy.

Who cares? You may ask. It leads to inflation and devaluation. Too much money in circulation chasing the same amount of goods leads to inflation. For example, inflation rose 0.8% in April and 4.2% on an annual basis, the highest spike since 2008 driven in part by a huge increase in food prices and others. The impact of inflation can also be seen in stocks and cryptocurrencies.

Remember the three stimulus checks issued to millions of struggling Americans? Instead of spending the money on food, savings, or paying off debts, some people invested their stimulus checks in stocks (GameStop, etc.), and cryptocurrencies like bitcoins further driving up their prices.

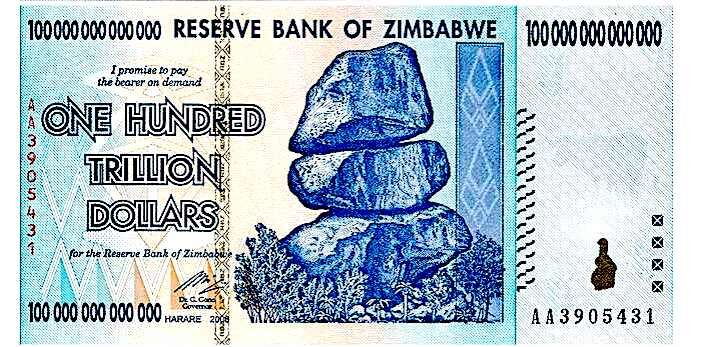

The other problem with the Fed printing too much money is that it leads to the debasement and the devaluation of the dollars. What the Fed is doing now has been tried throughout history. The outcome is always the same. Take, for example, Germany. Between June 1921 and November 1923 in Weimar Germany, the highest monthly inflation rate rose by over 30,000%. Zimbabwe is another country with hyperinflation.

In the video, Jake Tran takes us on a journey through history of countries that have tried to print their way out of the economic crisis only to find themselves in deeper economic woes. Jake also added that the reason why we haven't seen inflation is because the amount of money being printed is only one of the factors that contribute to inflation.

To get inflation, Jake explains, we need:

1. Industrial Output: How much "stuff" an economy makes

2. Employment: Too much employment leads to employers fighting over workers, which leads to higher wages, which leads to higher prices

3. The Money Supply: More money when an economy is producing the same amount or less stuff equals higher prices

4. Velocity of Money: If money is exchanging hands, and if so, how fast is it exchanging hands.

Governments, corporations & citizens request emergency bail-outs (Reaction).

Private Central Banks oblige with QE [Solution].

Their short-term goal will be to use the Cantillion Effect in order to become stake-holders in GPPP.

Their long-term goal is to complete the transition into a technocratic CBDC control system.