OF THE

TIMES

A nation that continues year after year to spend more money on military defense than on programs of social uplift is approaching spiritual doom.

When Johnson came out with the "axis of evil", you knew he was bought and paid for. The American Congress and Executive branch are jokes, and...

This only works if you (i.e. Micron) have full control over the judicatory system. Otherwise, it might backfire mightily. Although in Micron's...

Following the Hamas-led massacre at the Nova Music Festival on October 7, about fifty survivors have committed suicide, revealed Guy Ben Shimon....

Yes, Time magazine is garbage. However, I wonder about the author. Quote: "Everyone promotes. We should search for where the preponderance of...

Quote: "The Israeli Ministry of Health says that they do not have any information or statistics about the claim made of 50 survivors who have...

To submit an article for publication, see our Submission Guidelines

Reader comments do not necessarily reflect the views of the volunteers, editors, and directors of SOTT.net or the Quantum Future Group.

Some icons on this site were created by: Afterglow, Aha-Soft, AntialiasFactory, artdesigner.lv, Artura, DailyOverview, Everaldo, GraphicsFuel, IconFactory, Iconka, IconShock, Icons-Land, i-love-icons, KDE-look.org, Klukeart, mugenb16, Map Icons Collection, PetshopBoxStudio, VisualPharm, wbeiruti, WebIconset

Powered by PikaJS 🐁 and In·Site

Original content © 2002-2024 by Sott.net/Signs of the Times. See: FAIR USE NOTICE

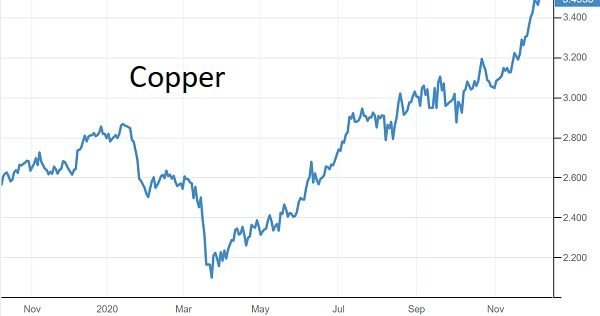

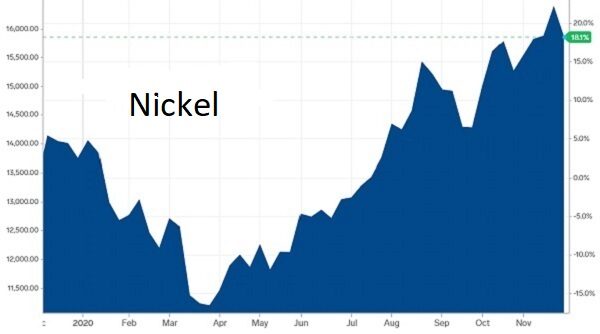

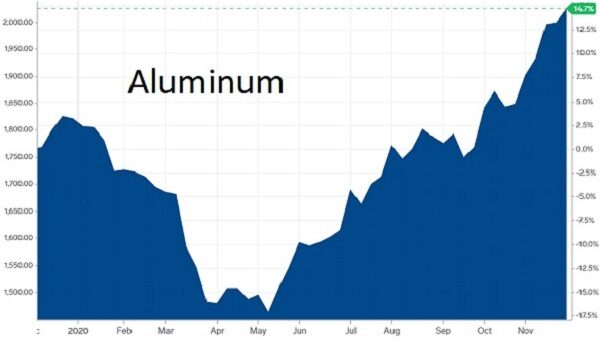

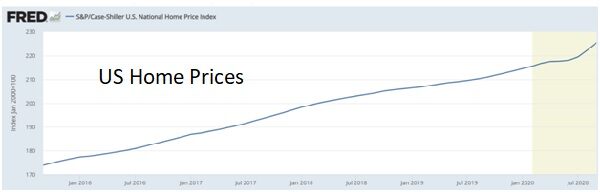

Comment: And that ain't all: