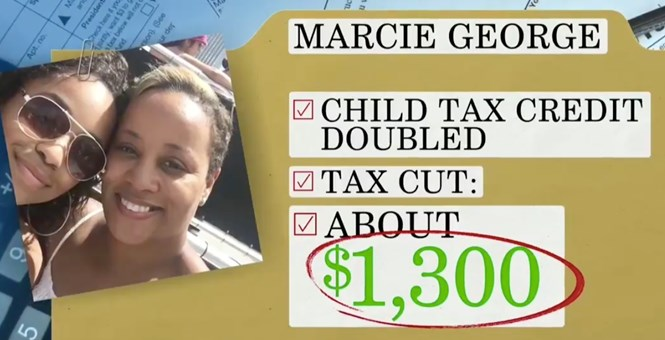

First, in a video I flagged as "must watch" on Twitter, CBS News delved into the personal finances of three families across the country to determine how the new tax law will impact them. Each household cut distinct profiles; a low-income single mother in North Carolina, a pair of middle-income married educators in Rhode Island, and married small business owners with three kids in California. One thing that all three families had in common: Anxiety about the GOP plan. None of them were optimistic about how the new system will affect their pocketbooks, with two families explicitly anticipating a tax hike. This reflects widespread public opposition to the bill, driven by aggressive misinformation from the Left. When an accountant ran the actual numbers, however, all three households discovered that their tax burden was going down. Watch the entire thing:

This really should not be a surprising outcome in the least, given that 80 percent of filers will see tax reductions under the bill -- yet this number cruncher's mathematical verdicts came as happy relief to these taxpayers, who'd succumbed to relentless propaganda and media malpractice. But reality did not comport with Democratic talking points. National Review's David French analyzes the importance of the CBS news segment:

This is exactly the dynamic Republicans are hoping for in 2018. Democrats and many members of the media relentlessly claimed the bill would hurt the middle class. They called it a "giveaway" to corporate America and to the very rich. Polls indicated that large numbers of Americans actually thought their taxes would increase. In other words, the public debate served mainly to obscure the truth and conceal the benefits to working families. So what happens when reality intervenes and Americans by the millions see their take-home pay increase? The GOP's hope is that it will lead to a public reconsideration and a rebound in Republican fortunes at the polls. And that's certainly possible. There has been an enormous amount of doom-mongering in the media and online, and if Republicans can keep America safe and prosperous in the coming year, and if family fortunes continue to improve, then some of the hysteria may lose its bite. Eventually people tune out Chicken Little.Click through to read his alternate scenario, which should concern a party that already trails heavily on the generic Congressional ballot. Meanwhile, Vermont Socialist Bernie Sanders -- who falsely described the Republican tax bill as a "massive attack" on the middle class -- was forced to admit that actually, 91 percent of middle class earners will receive a tax cut under this "massive attack," calling it a "very good thing." What a rhetorical shift:

Ninety-one percent. Bernie's complaint about the law is that the individual rate cuts were not made permanent. Republicans built in a "sunset" date for the tax cuts (a point we've addressed multiple times) so that they would hit certain revenue and budgetary targets in order to comply with reconciliation rules. Permanent tax cuts would have shown up as more lost revenue, thus growing deficits larger than their budget rules would allow. Senate Democrats, well aware of this dynamic, offered an amendment to make the cuts permanent, which would have blown up the bill (yes, Republicans could have radically altered the bill, trading away other measures they believe will spur economic growth to make the individual rate cuts permanent). Republicans voted it down. But remember: The only reason that the GOP was forced to play these numbers games was because they needed to pass the bill with a simple majority. Why? Zero Democrats in either chamber were willing to go along with their plan. Now that the bill has been passed and signed into law, and considering that Democrats got a lot of mileage out of the "corporate cuts are permanent, but individual cuts expire" attack, Rich Lowry has a good idea:

We've been arguing all along that the "expiration date" exploited by liberals to advance deeply misleading and cherry-picked claims about the legislation was always a fiction. Recent experience and strong political incentives each dictate that middle class tax cuts will not be allowed to disappear eight years down the line. Sanders just confirmed that on CNN. If one of the most liberal members of the Senate wants those cuts to be permanent, Republicans should oblige him with a vote. Tailor a new bill very narrowly to permanently extend the new law's tax cuts that benefit working class and middle income Americans. Bring it up as a stand-alone bill, "fill the tree" on Senate amendments, then let the Democrats vote on it. If they vote yes, they'll explode one of their only reasonably-defensible arguments against the bill (their alleged concerns about deficits -- a serious issue, I might add -- are laughable) while essentially conceding how helpful the law really is to middle income Americans (contra their entire mendacious messaging strategy). If they vote no, they'll be opposing their own idea, confirming that they cynically offered it just a few weeks ago solely as a means to derail the legislative process; they'd also highlight how the Democratic Party is the only party standing in the way of avoiding the future middle class tax hike about which Congressional Democrats say they're so terribly worried. Jam 'em, Paul and Mitch.

I'll leave you with a few additional examples of the misperceptions and lies that have taken root, which bear no resemblance to reality. First, I had a liberal relative in California inform me over the holidays that the majority of Californians will see tax increases because of the Republican law. In fact, 87 percent of Californians will receive a tax cut in 2019, with a vast majority (67 percent) still in the "winner" column even in 2027 -- after the unlikely "expiration" of cuts. The story I linked cites a poll showing a majority of California voters opposing a law that will directly benefit nearly nine in ten taxpayers. And then there's this bonkers column, which attempts to recast a sweeping tax cut -- benefiting 80 percent of households, and reducing taxes on average across every income group -- as "by far" the "largest tax increase" in American history. This is upside-down, pants-on-fire, utterly false, propaganda:

The column's author and his editors should be embarrassed to have run these lies. And then there's this:

The sheer volume of lies and misinformation flying around about this law is frustrating and very telling.

Reader Comments

If only they would have eliminated the Schedule B foreign accounts reporting requirement (even if no tax to report or exempt from needing to report), the related FBAR and the FATCA crap.