OF THE

TIMES

A nation that continues year after year to spend more money on military defense than on programs of social uplift is approaching spiritual doom.

Considering the level of rationality displayed on Western / EU side lately, I think they will do it anyway. Which only hastens their demise.

(Communications/Transportation Mercury Retrograde in Aries changed to forward motion conjunct the Nodes of Destiny simultaneously with our Scorpio...

Harari said, he and the likeminded cabal of shadowy world masters will "build an Ark and leave the rest to drown." Moonraker [Link]

With each such step we come closer to the fulfillment of Irlmaier's prophecy.

A once "prosperous" country has been ruined by its leaders and "oligarchs," the Belarusian president has claimed Yes, it is true; and the reason...

To submit an article for publication, see our Submission Guidelines

Reader comments do not necessarily reflect the views of the volunteers, editors, and directors of SOTT.net or the Quantum Future Group.

Some icons on this site were created by: Afterglow, Aha-Soft, AntialiasFactory, artdesigner.lv, Artura, DailyOverview, Everaldo, GraphicsFuel, IconFactory, Iconka, IconShock, Icons-Land, i-love-icons, KDE-look.org, Klukeart, mugenb16, Map Icons Collection, PetshopBoxStudio, VisualPharm, wbeiruti, WebIconset

Powered by PikaJS 🐁 and In·Site

Original content © 2002-2024 by Sott.net/Signs of the Times. See: FAIR USE NOTICE

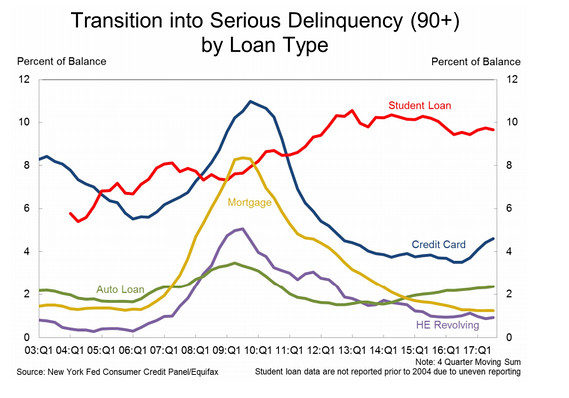

Comment: According to Paul Craig Roberts the job market is in the toilet: