- Bankers make NINJA loans, securitize them, and sell on to government GSEs

- Bankers destroy all the loan documents and begin random and fraudulent foreclosures, throwing millions of innocent victims out on the street

- GSEs sue bankers and force them to take back bad mortgages

- Bankers sell servicing rights for the same bad mortgages back to GSEs, who overpay

- GSEs resell servicing rights to companies run by former GSE officials

- Bankers slapped on wrist with puny foreclosure settlement in return for government promise it will never sue them for past foreclosure fraud

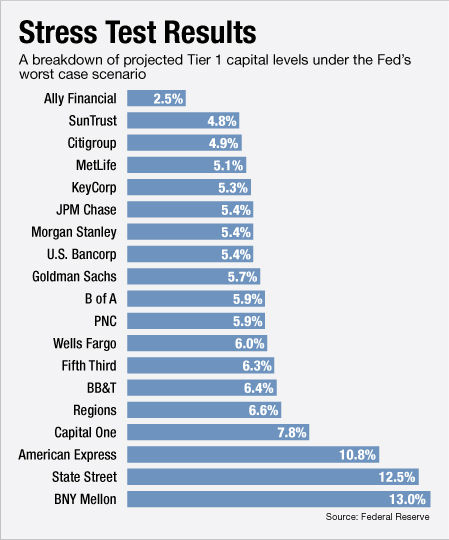

- Government stress test claims banks are healthy

- Bankers get sweet deal, counting mortgage mods for best borrowers toward the settlement

- HUD report released demonstrating massive foreclosure fraud that reached to highest levels of banks

- Vampire Squid Executive Director fires off resignation letter decrying bankster culture

- Banksters walk away scott-free as statute of limitations runs out for criminal behavior

Beginning in the late 1990s the biggest banks and GSEs created MERS to end-run around county recorders so that they would not have to pay fees to properly register sales of mortgages that would be securitized.

They then proceeded to lose or destroy all (or virtually all) the written documents, broke the chain of title, and screwed up even the electronic records. Nobody knows who owes what to whom, so the loan servicing arms of the biggest banks decided to go on a foreclosure frenzy to seize as many homes at random before anyone found out.

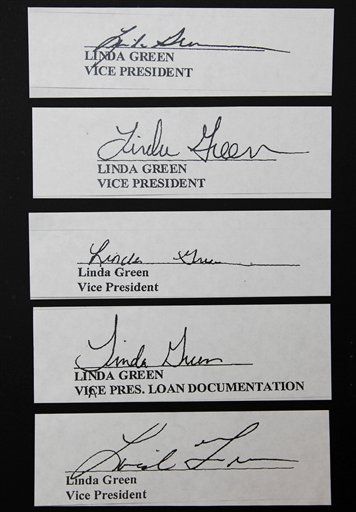

And that required the biggest forgery conspiracy the US has ever seen, with individual Robo-signers admitting to falsifying up to 10,000 documents each per month. Burger King floor-moppers and pizza delivery boys were promoted to JPMorgan Chase Vice Presidents to manufacture documents. I am not kidding - "the titles were given by Chase for the sole purpose of allowing individuals to sign documents and came with no other duties or authority".

A detailed review of 36 of Chase's foreclosures found that the bank was unable to find any documents related to how much the borrowers owed in 32 of them; there were documents in 4 cases, but docs for 3 of those were wrong. In other words, Chase actually had correct documents needed for foreclosure in only one case out of 36. And these were foreclosures it had successfully completed. In 35 out of 36 cases Chase had simply stolen the home - it had no documents showing what the homeowners supposedly owed. Maybe they owed nothing. We will never know. That is the state of home mortgages in America - thanks to Wall Street and MERS.

This is what led to the recent "foreclosure settlement" that let the worst banksters off the hook with a tiny little slap on their dirty hands. It totaled $26 billion, but as is widely reported hardly any of that is real money - see below. In return for the token payments the banks got to walk scot-free away from lawsuits: 49 state attorneys general as well as the federal authorities have agreed they will not be able to sue the banksters for crimes like robo-signing.

But here is the funny thing about the settlement: the details were not announced at the time - instead the authorities dragged their feet until the end of last week.

We now know why: it looks like they were waiting for the government's "stress tests" to be readied for damage control. Let me explain.

Last Thursday the details of Bank of America's deal were released. Recall that BofA had taken over Countrywide, queen of the fraudulent mortgages. BofA has the second biggest servicer, and is servicing some of the lowest quality mortgages in the country. Further, Countrywide was notoriously sloppy in its record keeping. Ergo, BofA's foreclosure fraud record was among the worst and it got hit owing $11.8 billion of the $26 billion settlement.

But you know the government is going to cut BofA a sweet deal - it is a $2 trillion dollar behemoth that is way too big to fail. Now, the vast majority of the settlement fund is not real money - it is funny accounting money. The banks agreed to provide about $20 billion of the $26 billion in the form of debt reduction or lower interest rates for just 1 million homeowners.

(Only $1.5 billion will go to the homeowners who already lost their homes to thieving banks - who only have to provide $1,500 to $2000 for each home they foreclosed improperly. Home theft by a bankster is not a serious crime in America, after all.)

The details on BofA's deal stink. BofA is going to provide principal reductions for 200,000 homeowners with mortgages greater than $100,000. None of these can be mortgages owned by Fannie or Freddie, nor can they be backed by the FHA or the VA (our veterans are exempt from mortgage relief?). And those owners getting the deal must have mortgages owned or at least serviced by BofA, they must be underwater, and the must be 60 days or more overdue.

Now think about those conditions. The target is certainly not going to be lower income households - with smaller mortgages, and who tend to rely on FHA and VA. It looks a lot like the redlining banks used to do (drawing a redline around areas they would not lend to, mostly populated by lower income minorities) - by design it will disproportionately help white borrowers.

And the deal says nothing about homeowners most in danger of losing their homes - those already in default. Rather it looks like BofA will be cream-skimming, including mortgages it probably would have modified anyway! So it will get to count money it would have spent even without the settlement toward the $12 billion or so that it owes.

And here is where the plot thickens. If you go all the way back to last summer there were some reports about BofA playing "hide and seek" with Fannie. So recall that the banks made toxic NINJA (no income, no job, no asset, no problem) subprime mortgage loans, then packaged them into securities. It sold a lot of these to the GSEs (Fannie and Freddie). After the crisis hit, Fannie sued some of the banks because those securities did not meet the "reps and warranties", forcing BofA to take some of them back. Then last summer BofA's servicing arm sold the servicing rights to some 400,000 rotten mortgages to Fannie - which had not been happy with the bank's success at squeezing blood out of defaulting homeowners.

(To be sure there is more to the story than this, because the interests of a servicer are in conflict with the interests of the banks and securities holders - I won't go into this now, but it sometimes makes sense to drag a foreclosure out long enough to eat up the full value of the underlying house in fees due to the servicer.)

At the time, many analysts thought Fannie paid far too much ($500 million) for these servicing rights on mortgages with potentially high default rates. It looked like a government bail-out of BofA, since Fannie could just use government money to pay for the rights - rights that private servicers did not appear to want since none of BofA's competitors was stepping up to bid for them. As Francine McKenna at Forbes revealed at the time, Countrywide's former auditor (KPMG) was also the auditor of Fannie, and BofA's auditor (PricewaterhouseCoopers) was also the auditor of Freddie (as well as the FHLBs and AIG - two other institutions that sued BofA to take back bad loans).

McKenna thus speculated that these auditors were in a good position to know which loans had been put back to BofA and also which loans were included in the servicing rights that were sold to Fannie.

If you were a suspicious sort, you might wonder if those same toxic mortgages that BofA had to buy back from Fannie were involved in some sort of "payback" by Fannie to BofA in the form of an overpayment for servicing rights.

Oh, but it gets worse. (Doesn't it always?)

Fannie has continued to buy servicing rights from the biggest servicers (perhaps continuing to overpay for them) and then selling the rights to a handful of favored specialty servicing firms like Nationstar.

Guess who runs Nationstar's parent company? If you guessed Donald Mudd, formerly Fannie's chief business officer you'd be right. And all of this is done in secret.

Nay, top secret. American Banker submitted a Freedom of Information Act request to get documents related to these deals. The Federal Housing Finance Agency uncovered 4000 pages of documents related to the request but said not a single page could be released even in redacted form. This stuff is more secret than Presidentially-ordered assassinations of American citizens.

Heard enough? Not yet. It gets worse.

The foreclosure settlement as well as the bank stress tests were conducted and released before the Department of Housing and Urban Development released its examination of bank foreclosure practices on Monday. That report documented widespread abusive practices at the biggest banks. It shows the potentially illegal activities were not only known by top management, but also encouraged by management. Indeed, when mid-level managers tried to report and stop illegal activity, top management directed them to shut up and get with the program.

Gee do you think it would have been nice to have that report before settling with the banksters?

By releasing the HUD report after the settlement, the state attorneys general were denied material information that could have strengthened their bargaining position. And the timing is certainly unfortunate if not intentional as it came after the government certified that most of the biggest banks had passed the wimpy stress tests - to minimize damage to bank stock prices that could have been done by the HUD study.

And, finally. I am sure you are as shocked (shocked!) as I am at the kiss-and-tell resignation letter by Goldman Sach's Greg Smith. Did you know that Goldman rewards employees who push the worst toxic waste onto Goldman's own clients? Simply shocking!

Look, as I wrote a long time ago it is a common claim among competitors that when a customer comes to Goldman for financing, Goldman puts together two teams. One tries to convince the customer to take the worst terms possible while the other team creates derivatives to bet on the customer's failure. And given what we know about the deal Goldman cut with hedge fund manager John Paulson, that certainly rings true. But now we've got it straight from the horse's mouth, so to speak. Read it for yourself.

And that statute of limitations clock just keeps on ticking while the Obama Administration keeps on fiddling.

Other reference on the sale of servicing by BofA:

Federal Housing Finance Agency, Office of Inspector General, Semiannual Report to the Congress, April 1, 2011, through September 30, 2011

NINJA loans, it would be funny if the consequences weren't so despicable.