Financial transactions in the days before the attack suggest that certain individuals used foreknowledge of the attack to reap huge profits.1 The evidence of insider trading includes:

- Huge surges in purchases of put options on stocks of the two airlines used in the attack -- United Airlines and American Airlines

- Surges in purchases of put options on stocks of reinsurance companies expected to pay out billions to cover losses from the attack -- Munich Re and the AXA Group

- Surges in purchases of put options on stocks of financial services companies hurt by the attack -- Merrill Lynch & Co., and Morgan Stanley and Bank of America

- Huge surge in purchases of call options of stock of a weapons manufacturer expected to gain from the attack -- Raytheon

- Huge surges in purchases of 5-Year US Treasury Notes

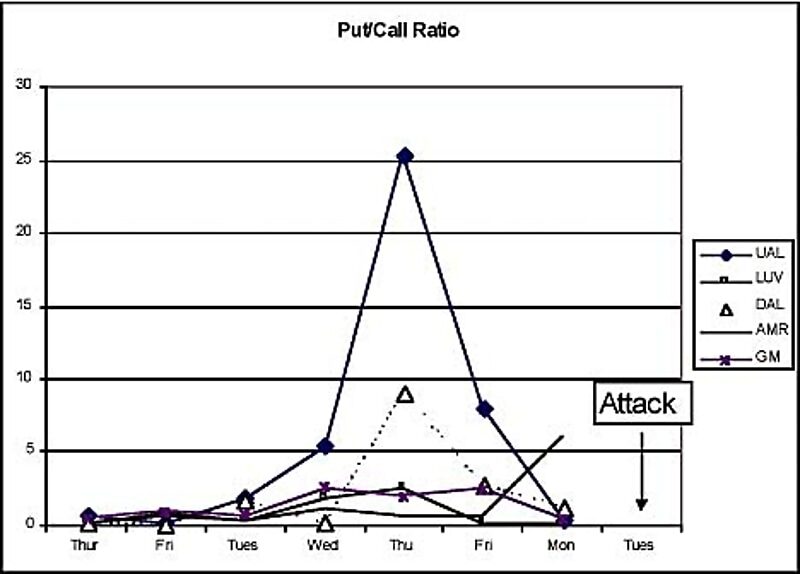

Put and call options are contracts that allow their holders to sell and buy assets, respectively, at specified prices by a certain date. Put options allow their holders to profit from declines in stock values because they allow stocks to be bought at market price and sold for the higher option price. The ratio of the volume of put option contracts to call option contracts is called the put/call ratio. The ratio is usually less than one, with a value of around 0.8 considered normal.2

Losers

American Airlines and United Airlines, and several insurance companies and banks posted huge loses in stock values when the markets opened on September 17. Put options -- financial instruments which allow investors to profit from the decline in value of stocks -- were purchased on the stocks of these companies in great volume in the week before the attack.

United Airlines and American Airlines

Two of the corporations most damaged by the attack were American Airlines (AMR), the operator of Flight 11 and Flight 77, and United Airlines (UAL), the operator of Flight 175 and Flight 93. According to CBS News, in the week before the attack, the put/call ratio for American Airlines was four.3 The put/call ratio for United Airlines was 25 times above normal on September 6.4

On Sept. 6-7, when there was no significant news or stock price movement involving United, the Chicago exchange handled 4,744 put options for UAL stock, compared with just 396 call options -- essentially bets that the price will rise. On Sept. 10, an uneventful day for American, the volume was 748 calls and 4,516 puts, based on a check of option trading records.5The Bloomberg News reported that put options on the airlines surged to the phenomenal high of 285 times their average.

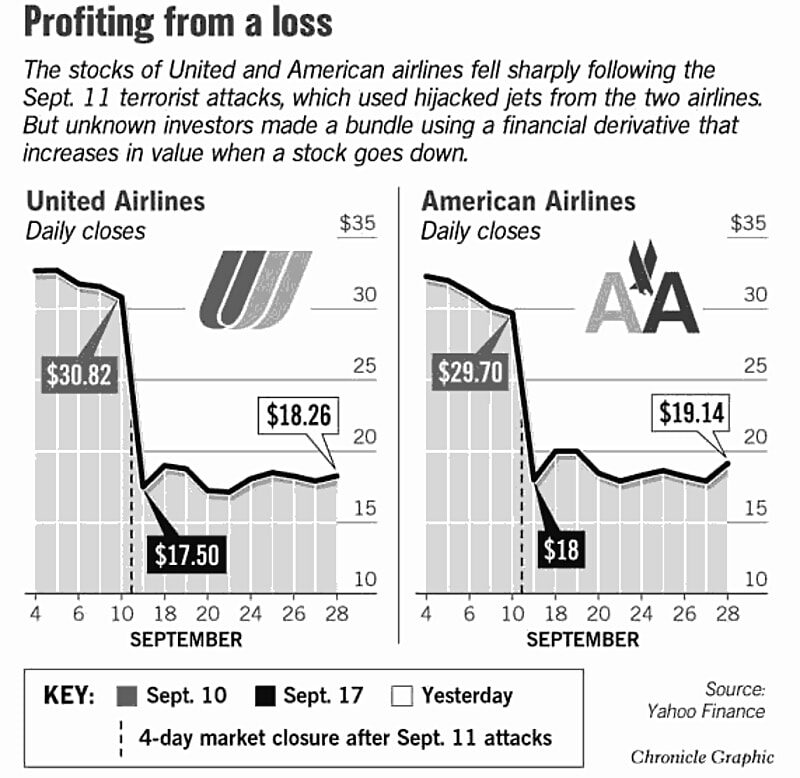

Over three days before terrorists flattened the World Trade Center and damaged the Pentagon, there was more than 25 times the previous daily average trading in a Morgan Stanley "put" option that makes money when shares fall below $45. Trading in similar AMR and UAL put options, which make money when their stocks fall below $30 apiece, surged to as much as 285 times the average trading up to that time.6When the market reopened after the attack, United Airlines stock fell 42 percent from $30.82 to $17.50 per share, and American Airlines stock fell 39 percent, from $29.70 to $18.00 per share.7

Reinsurance Companies

Several companies in the reinsurance business were expected to suffer huge losses from the attack: Munich Re of Germany and Swiss Re of Switzerland -- the world's two biggest reinsurers, and the AXA Group of France. In September, 2001, the San Francisco Chronicle estimated liabilities of $1.5 billion for Munich Re and $0.55 bilion for the AXA Group and telegraph.co.uk estimated liabilities of £1.2 billion for Munich Re and £0.83 billion for Swiss Re. 89

Trading in shares of Munich Re was almost double its normal level on September 6, and 7, and trading in shares of Swiss Re was more than double its normal level on September 7.10

Financial Services Companies

Merrill Lynch and Morgan Stanley Morgan Stanley Dean Witter & Co. and Merrill Lynch & Co. were both headquartered in lower Manhattan at the time of the attack. Morgan Stanley occupied 22 floors of the North Tower and Merrill Lynch had headquarters near the Twin Towers. Morgan Stanley, which saw an average of 27 put options on its stock bought per day before September 6, saw 2,157 put options bought in the three trading days before the attack. Merrill Lynch, which saw an average of 252 put options on its stock bought per day before September 5, saw 12,215 put options bought in the four trading days before the attack. Morgan Stanley's stock dropped 13% and Merrill Lynch's stock dropped 11.5% when the market reopened.11

Bank of America showed a fivefold increase in put option trading on the Thursday and Friday before the attack.

A Bank of America option that would profit if the No. 3 U.S. bank's stock fell below $60 a share had more than 5,900 contracts traded on the Thursday and Friday before the Sept. 11 assaults, almost five times the previous average trading, according to Bloomberg data. The bank's shares fell 11.5 percent to $51 in the first week after trading resumed on Sept. 17.12Winners

While most companies would see their stock valuations decline in the wake of the attack, those in the business of supplying the military would see dramatic increases, reflecting the new business they were poised to receive.

Raytheon

Raytheon, maker of Patriot and Tomahawk missiles, saw its stock soar immediately after the attack. Purchases of call options on Raytheon stock increased sixfold on the day before the attack.

A Raytheon option that makes money if shares are more than $25 each had 232 options contracts traded on the day before the attacks, almost six times the total number of trades that had occurred before that day. A contract represents options on 100 shares. Raytheon shares soared almost 37 percent to $34.04 during the first week of post-attack U.S. trading.13Raytheon has been fined millions of dollars inflating the costs of equipment it sells the US military. Raytheon has a secretive subsidiary, E-Systems, whose clients have included the CIA and NSA.14

US Treasury Notes

Five-year US Treasury notes were purchased in abnormally high volumes before the attack, and their buyers were rewarded with sharp increases in their value following the attack.

The Wall Street Journal reported on October 2 that the ongoing investigation by the SEC into suspicious stock trades had been joined by a Secret Service probe into an unusually high volume of five-year US Treasury note purchases prior to the attacks. The Treasury note transactions included a single $5 billion trade. As the Journal explained:The SEC's Investigation"Five-year Treasury notes are among the best investments in the event of a world crisis, especially one that hits the US. The notes are prized for their safety and their backing by the US government, and usually rally when investors flee riskier investments, such as stocks."The value of these notes, the Journal pointed out, has risen sharply since the events of September 11.15

Shortly after the attack the SEC circulated a list of stocks to securities firms around the world seeking information.16 A widely circulated article states that the stocks flagged by the SEC included those of the following corporations: American Airlines, United Airlines, Continental Airlines, Northwest Airlines, Southwest Airlines, US Airways airlines, Martin, Boeing, Lockheed Martin Corp., AIG, American Express Corp, American International Group, AMR Corporation, AXA SA, Bank of America Corp, Bank of New York Corp, Bank One Corp, Cigna Group, CNA Financial, Carnival Corp, Chubb Group, John Hancock Financial Services, Hercules Inc., L-3 Communications Holdings, Inc., LTV Corporation, Marsh & McLennan Cos. Inc., MetLife, Progressive Corp., General Motors, Raytheon, W.R. Grace, Royal Caribbean Cruises, Ltd., Lone Star Technologies, American Express, the Citigroup Inc., Royal & Sun Alliance, Lehman Brothers Holdings, Inc., Vornado Reality Trust, Morgan Stanley, Dean Witter & Co., XL Capital Ltd., and Bear Stearns.

An October 19 article in the San Francisco Chronicle reported that the SEC, after a period of silence, had undertaken the unprecedented action of deputizing hundreds of private officials in its investigation:

The proposed system, which would go into effect immediately, effectively deputizes hundreds, if not thousands, of key players in the private sector.Michael Ruppert, a former LAPD officer, explains the consequences of this action:

...

In a two-page statement issued to "all securities-related entities" nationwide, the SEC asked companies to designate senior personnel who appreciate "the sensitive nature" of the case and can be relied upon to "exercise appropriate discretion" as "point" people linking government investigators and the industry.17

What happens when you deputize someone in a national security or criminal investigation is that you make it illegal for them to disclose publicly what they know. Smart move. In effect, they become government agents and are controlled by government regulations rather than their own conscience. In fact, they can be thrown in jail without a hearing if they talk publicly. I have seen this implied threat time and again with federal investigations, intelligence agents, and even members of the United States Congress who are bound so tightly by secrecy oaths and agreements that they are not even able to disclose criminal activities inside the government for fear of incarceration.18Interpreting and Reinterpreting the Data

An analysis of the press reports on the subject of apparent insider trading related to the attack shows a trend, with early reports highlighting the anomalies, and later reports excusing them. In his book Crossing the Rubicon Michael C. Ruppert illustrates this point by first excerpting a number of reports published shortly after the attack:

Ruppert then illustrates an apparent attempt to bury the story by explaining it away as nothing unusual. A September 30 New York Times article claims that "benign explanations are turning up" in the SEC's investigation.20 The article blames the activity in put options, which it doesn't quantify, on "market pessimism," but fails to explain why the price of the stocks in the airlines doesn't reflect the same market pessimism.[Excerpted ENDNOTES]

- A jump in UAL (United Airlines) put options 90 times (not 90 percent) above normal between September 6 and September 10, and 285 times higher than average on the Thursday before the attack. -- CBS News, September 26

- A jump in American Airlines put options 60 times (not 60 percent) above normal on the day before the attacks. -- CBS News, September 26

- No similar trading occurred on any other airlines -- Bloomberg Business Report, the Institute for Counterterrorism (ICT), Herzliyya, Israel [citing data from the CBOE] 3

- Morgan Stanley saw, between September 7 and September 10, an increase of 27 times (not 27 percent) in the purchase of put options on its shares. 4

- Merrill-Lynch saw a jump of more than 12 times the normal level of put options in the four trading days before the attacks. 5

3. "Mechanics of Possible Bin Laden Insider Trading Scam," Herzlyya International Policy Institute for Counter Terrorism (ICT), September 22, 2001. Michael C. Ruppert, "The Case for Bush Administration Advance Knowledge of 9-11 Attacks," From the Wilderness April 22, 2002. Posted at Centre for Research and Globalization <www.globalresearch.ca/articles/RUP203A.html>.

4. ICT, op. cit, citing data from the Chicago Board of Options Exchange (CBOE). [...] "Terrorists trained at CBPE." Chicago Sun-Times, September 20, 2001, <www.suntimes.com/terror/stories/cst-nws-trade20.html>. "Probe of options trading link to attacks confirmed," [...] Chicago Sun-Times, September 21, 2001, <www.suntimes.com/terror/stories/cst-fin-trade21.html>.

5. ICT, op. cit.

19

The fact that $2.5 million of the put options remained unclaimed is not explained at all by market pessimism, and is evidence that the put option purchasers were part of a criminal conspiracy.21

References:

1. Insider Trading Apparently Based on Foreknowledge of the 9/11 Attacks, London Times, 9/18/01 [cached]

2. Put/Call Ratio, StreetAuthority.com,

3. Profiting From Disaster?, CBSNews.com, 9/19/01 [cached]

4. Prices, Probabilities and Predictions, OR/MS Today, [cached]

5. Exchange examines odd jump, Associated Press, 9/18/01 [cached]

6. SEC asks Goldman, Lehman for data, Bloomberg News, 9/20/01 [cached]

7. Black Tuesday: The World's Largest Insider Trading Scam?, ict.org.il, September 19, 2001 [cached]

8. Suspicious profits sit uncollected Airline investors seem to be lying low, San Francisco Chronicle, 9/29/01 [cached]

9. Profits of doom, telegraph.co.uk, 9/23/01 [cached]

10. Profits of doom ..., 9/23/01

11. Black Tuesday ..., 9/19/01

12. Bank of America among 38 stocks in SEC's attack probe, Bloomberg News, 10/3/01 [cached]

13. Bank of America ..., 10/3/01

14. Raytheon, corpwatch.org,

15. Suspicious trading points to advance knowledge by big investors of September 11 attacks, wsws.org, 10/5/01 [cached]

16. Bank of America ..., 10/3/01

17. SEC wants data-sharing system Network of brokerages would help trace trades by terrorists, San Francisco Chronicle, 9/19/01 [cached]

18. Crossing the Rubicon, , page 243

19. Crossing the Rubicon, , page 238-239,634

20. Whether advance knowledge of U.S. attacks was used for profit, New York Times, 9/30/01 [cached]

21. Suspicious profits ..., 9/29/01

Who were the terrorists ?

There were no airplanes in real life ! Just on TV screens !