RTSun, 21 Apr 2019 18:30 UTC

© Getty Images

Sixty of America's biggest companies from the Fortune 500 list, including IBM, Netflix, General Motors and Chevron,

managed to avoid paying a dime in income taxes on their whopping profits last year.

After the explosive

report on how Jeff Bezos' Amazon used tax loopholes and paid nothing in taxes for two years in a row, the Institute on Taxation and Economic Policy (ITEP) revealed that

many more US companies did the same thing absolutely legally in 2018.

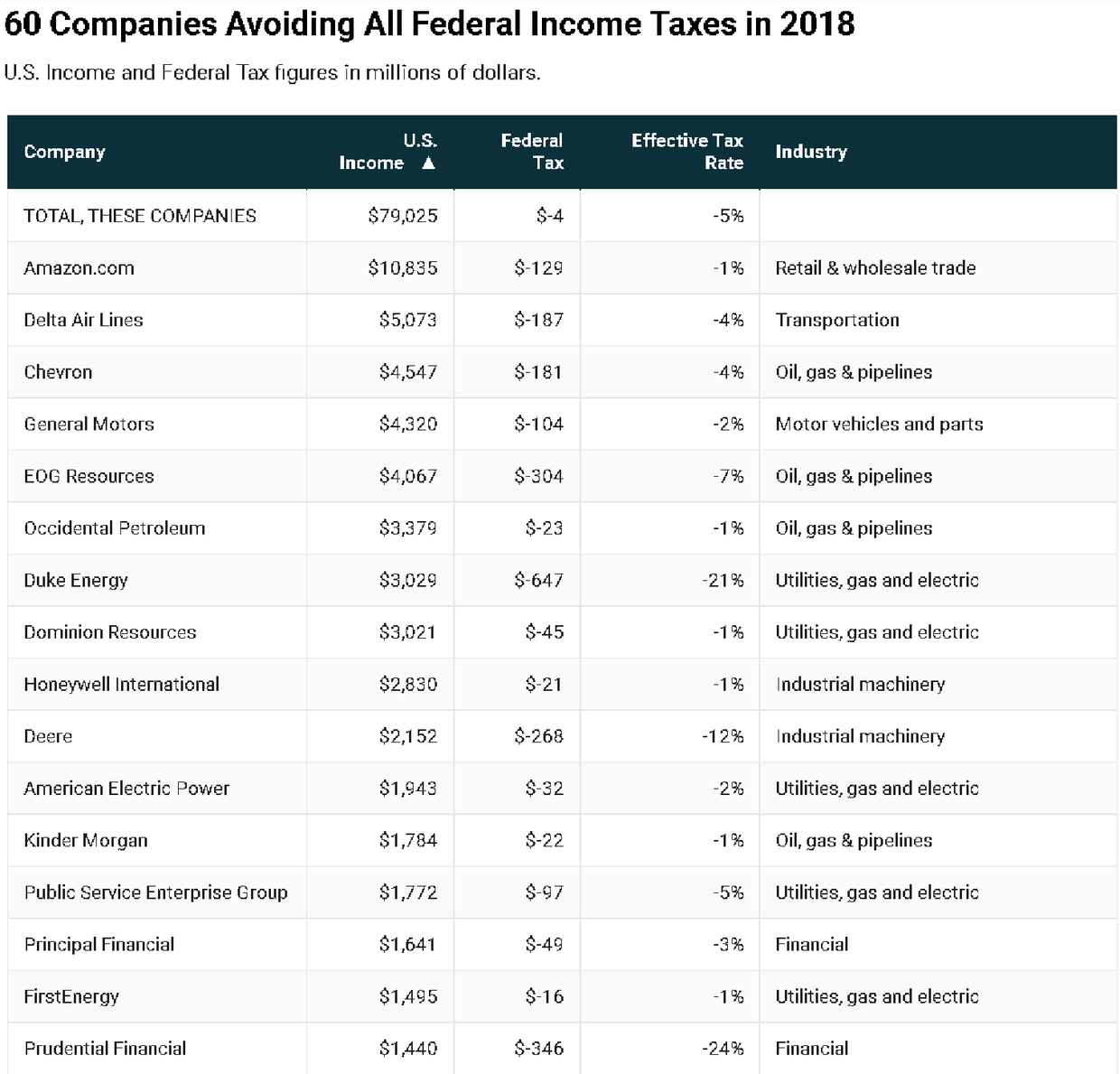

They include 60 major firms from different sectors of the US economy from retail to oil and gas. For example, Delta Air Lines paid nothing to Uncle Sam despite recording over $5 billion in profits. Energy major Chevron and automotive giant General Motors also paid zero tax, with each having earned more than $4 billion last year.In total, the listed companies zeroed out federal income taxes on $79 billion in US pretax income, according to ITEP findings. And

instead of paying $16.4 billion in taxes, these corporations enjoyed a net corporate tax rebate of $4.3 billion.

© ITEPTop companies avoiding all federal income taxes in 2018

"The result, unsurprisingly, has been a continued decline in our already low corporate tax revenues: in fiscal 2018, US corporate tax revenues fell by 31 percent, according to US Treasury data," the authors of the report said. "This was a more precipitous decline than in any year of normal economic growth in US history."

The diverse array of legal tax breaks includes accelerated depreciation (used, for example, by Chevron and Delta Airlines among others) as well a tax break for stock options, from which Amazon and Netflix benefited. The latter - with $856 million in profit - reduced its income taxes by $191 million by taking advantage of this tax break and paying nothing.

However, it is not clear how exactly some of these companies managed to zero their federal tax payments. Despite the report citing the corporations' annual financial filings, it notes that their tax provisions are often vague and do not clearly state what kind of tax breaks they used.Still, there is "nothing obviously illegal" in the companies actions, the ITEP said, calling on the government "to require a higher standard of tax disclosure by publicly traded firms" to achieve full understanding of how profitable corporations are avoiding taxes.

Comment: They literally are the government now, directly subsidizing themselves from the public treasury.

The income taxes are for US, the peon slaves who are not part of their system.