According to new findings released by Global Witness, an environmental watchdog organisation, the European Union bought 21.6 million cubic metres (mcm) of Russian LNG between January and July of this year, a small increase compared to the same period in 2022, when imports totalled 21.3 mcm.

But when the 2023 figure is measured against the same period in 2021, prior to the Kremlin's decision to wage war on Ukraine, it results in a 39.5% surge, an embarrassing percentage for a bloc that has forcefully condemned the invasion as an illegal, brutal and ruthless attempt to subjugate Ukraine's independence.

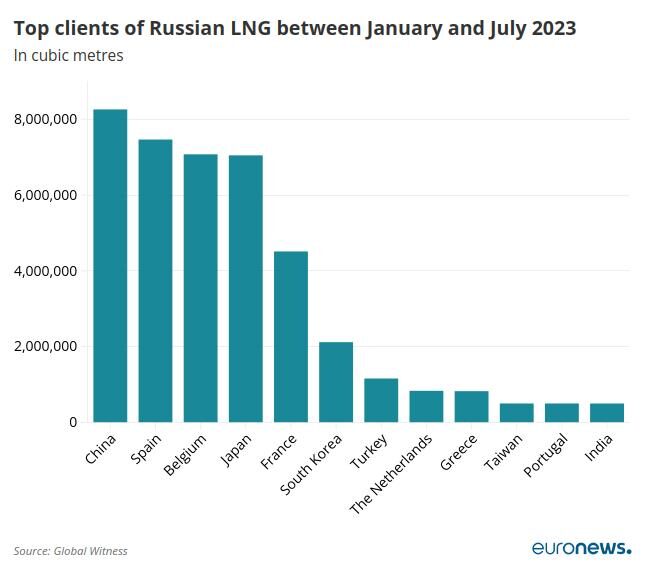

Making matters more uncomfortable, three member states can be found among the five major clients of Russian LNG in the first seven months of his year: China came on top with 8.7 mcm in purchases, followed by Spain (7.5 mcm), Belgium (7.1 mcm), Japan (7 mcm) and France (4.5 mcm).

As coastal countries, Spain, Belgium and France have become busy destinations for LNG carriers, which need to unload their supplies on sophisticated terminals where the cooled-down liquid is turned back into gaseous form and sent to power plants.

The Netherlands, Greece, Portugal, Finland, Italy and Sweden were also listed by Global Witness as current consumers of Russian LNG. The numbers are based on shipping data obtained from Kpler, an analytics firm.

Overall, the EU is estimated to have bought 52% of all of Russia's LNG exports between January and July, a market share that exceeds the 49% mark of 2022 and 39% of 2021.

Comment: It's possible they're stocking up because they know that, at some point, their own actions could cause the supply to be cut off; the US seems to be aware of the same issue with Russian uranium: US doubles imports of Russian Uranium, largest amount since 2005

This year's shopping spree was worth €5.29 billion, Global Witness said, an amount that throws into question the bloc's efforts to weaken the Kremlin's war chest, which is fundamentally sustained by international sales of fossil fuels.

Since the start of the war, the EU has banned imports of Russian coal and Russian seaborne oil but has conspicuously spared those of Russian gas. While flows of pipeline gas have been dramatically reduced through national plans and Vladimir Putin's retaliation, tanks of Russian LNG appear to be warmly welcomed at European ports.

"Buying Russian gas has the same impact as buying Russian oil. Both fund the war in Ukraine, and every euro means more bloodshed. While European countries decry the war, they're putting money into Putin's pockets," Jonathan Noronha-Gant, a senior fossil fuel campaigner at Global Witness, said in a statement.

Data from Eurostat paints a similar pattern: in the first quarter of 2023, Russia was the EU's second-largest supplier of LNG, only behind the United States and ahead of Qatar, Algeria, Norway and Nigeria.

Market data analysed by Bruegel, a Brussels-based economic think tank, shows no considerable variation in the flows of Russian LNG, despite the multiple rafts of sanctions and growing evidence of possible war crimes committed inside Ukraine: the EU bought 1.99 mcm of Russian LNG in March 2022, the first full month of the invasion, and 1.59 mcm in July 2023, the last month on record.

"European companies still sit on offtake contracts for Russian LNG. They are i) obliged to keep taking this gas up to a certain volume if they do not want to violate the contract, and ii) incentivised to import high shares under their contracts given the huge EU demand for LNG," said Ben McWilliams, an affiliate fellow at Bruegel.

"I do not find it surprising that the share of Russian LNG increases - until the EU takes sanctions action on Russian LNG the flows will not decrease."

Isaac Levi, a senior analyst at the Centre for Research on Energy and Clean Air (CREA), a research institution that also tracks Russia's fossil fuel sales, warned that even though coastal countries are the primary point of arrival for LNG carriers, the final consumers might lie elsewhere across Europe.

Comment: Indeed; and these coastal nations will be selling it a mark up to a variety of other Western nations who may otherwise claim to be 'reducing' their reliance on Russian energy products: Russian oil floods global markets via major Asian intermediaries

"When LNG cargoes are discharged in these countries, it doesn't necessarily imply that the gas molecules remain there," Levi said. "Instead, the possibility of Russian LNG being re-exported to other EU destinations exists."

Following the publication of the report, the European Commission, which has drawn ambitious plans to achieve independence from Russian fossil fuels, said the LNG numbers should be put in the context of the "dramatic change" that has swept the bloc's energy mix since the Kremlin ordered the invasion.

In 2021, the EU imported 40% of its gas from Russia (around 155 billion cubic metres), the vast majority coming through pipelines. In the first half of 2023, that shared plunged to less than 15 per cent.

Comment: It's not coming through pipelines anymore, no. Instead it's being imported in the form of unreliable, inefficient, and expensive LNG. It has also forced nations to restart coal plants and other 'dirty' energy sources. And since that still doesn't compensate for the loss of Russian gas, the West continues to scramble around for energy supplies elsewhere. Another consequence was that it brought about a near global energy crisis that is impoverishing Europeans, and who suffered a winter where the threat of blackouts was ever present.

"The EU has ended all imports of Russian coal. It's reduced Russian oil imports by around 90%. And we've cut total Russian gas imports by around two-thirds," a European Commission spokesperson said on Thursday.

"So even though LNG volumes have increased, it's still a relatively small level and a very small share of our overall energy imports."

Reader Comments

to our Newsletter