Under a federal guideline known as "borrower defense to repayment," the Education Department can forgive federal student loans when a college or university is found to have engaged in predatory behavior.

From the time this statute took effect in 1995 through mid-2015, the Department of Education received just five claims for federal student loan forgiveness. But with the collapse of major for-profit college chains like Corinthian Colleges and ITT Technical starting in 2015, thousands of students found themselves unemployable or with incomplete degrees - as well as deeply in debt.

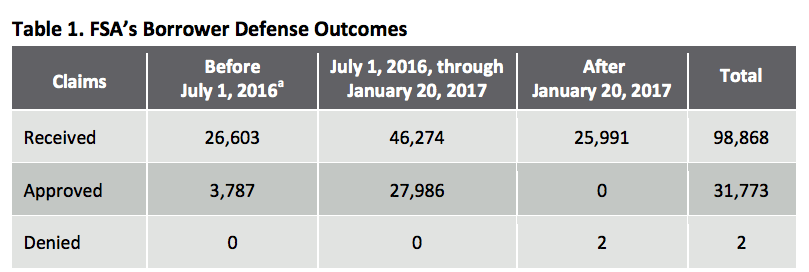

Many of these students would go on to seek debt relief from the Obama administration. From June 2015 to January 2017, the Department of Education received more than 72,000 borrower defense claims. More than 31,000 were ultimately approved by the Obama administration, with roughly half of all approvals coming in the final month of his presidency.

In the first seven months of the Trump administration, the Education Department received an additional 26,000 applications for borrower defense, bringing the government's backlog to roughly 65,000 cases as of July. But the administration has yet to approve any of these claims, according to the inspector general report. It has denied at least two.

While 12,000 claims have been flagged for approval as of July 31, the applications await final sign-off, according to the report. Another 7,200 have been flagged for denial.

The growing backlog has fueled criticism from many student advocates and Democrats in Congress who have called on Education Secretary Betsy DeVos to begin processing pending claims and provide full relief for claims awaiting final sign-off. According to a report released by Sen. Elizabeth Warren (D-Mass) and Sen. Richard Durbin (D-Ill.) in November, the backlog has grown from 65,000 claims in July to more than 87,000 as of Oct. 24.

"Despite the growing backlog of borrower defense claims, the Department of Education, under Secretary Betsy Devos has demonstrated little interest in helping students get the relief to which they are legally entitled," the lawmakers wrote in their report.

The administration has defended its process, saying the Obama administration failed to "establish an adequate adjudication process for borrower defense claims," according to a statement from Liz Hill, press secretary at the Department of Education. "Secretary DeVos is working to put a process in place that provides a consistent and reliable way to adjudicate pending borrower defense claims, provide fair relief to defrauded students and also protect taxpayers."

In June, DeVos delayed the implementation of Obama-era updates to a regulation that would simplify the process of federal student debt forgiveness for students who have been defrauded. DeVos has said the Obama-era rules are "unfair to students and schools, and puts taxpayers on the hook for significant costs."

Meanwhile, legislation currently being considered in the House would repeal the Obama-era rules around borrower defense and block them from being readopted.

What was the criteria for exemption?