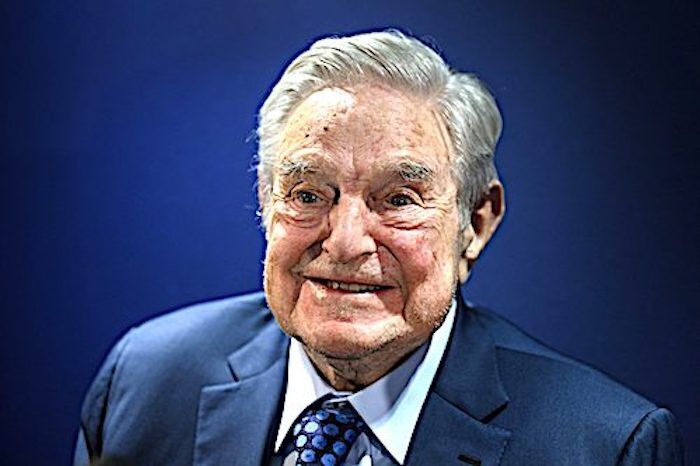

© Fabrice Coffrini/AFP/GettyImagesGeorge Soros

according to court filings and sources close to the situation.

The left-leaning billionaire's Soros Fund Management has

bought up $400 million of debt in Audacy — the No. 2 US radio broadcaster behind iHeartMedia with

stations including New York's WFAN and 1010 WINS, as well as Los Angeles-based KROQ, according to bankruptcy filings.

One insider close to the situation, noting that he was a Republican, said he believed

it was possible Soros was buying the stake to exert influence on public opinion in the months leading up to the 2024 presidential election.

"This is scary," the source said.

Sources told

The Post that

Soros's stake is equal to about 40% of the company's senior debt — a massive chunk which, although not a majority,

could yield effective control of the media giant when it emerges from bankruptcy.Soros scooped up the debt during the past few weeks at roughly 50 cents on the dollar from hedge fund HG Vora, according to a source close to the situation.

Audacy confimed the Soros' investment after reports of the deal surfaced.

"The decision by our existing and new debtholders to become equity holders in Audacy represents a significant vote of confidence in our company and the future of the radio and audio business," Audacy said in a statement.

Soros Fund didn't respond to a request for comment. A spokesperson for HG Vora declined to comment.

A hearing to approve the Audacy restructuring plan is slated for Feb. 20 before US Judge Christopher Lopez in a Houston bankruptcy court.

Audacy filed for bankruptcy on Jan. 7 with $1.9 billion of debt.Under Audacy's current Chapter 11 bankruptcy plan,

existing shareholders are expected to be wiped out.High-ranking creditors like Soros would be repaid with stock in the restructured company.The proposal requires bankruptcy court approval.

It's

the latest media play for Soros.

Last summer, a fund linked to

Soros joined a consortium of former lenders who paid $350 million for bankrupt Vice Media — an outlet that at its peak was

once valued at $6 billion.A judge in Manhattan federal bankruptcy court ruled that Soros Fund Management and Fortress Investment Group represented the best option to take the Brooklyn-based company out of Chapter 11 bankruptcy.

The fire sale marked the stunning demise of Vice, which was co-founded by larger-than-life media exec Shane Smith.

Smith, who ran the business as CEO from its founding in 1994 until 2018, left amid a series of reports about alleged a frat house-like culture at the company.

Reader Comments

Soros / Davros , same difference.....

[Link]

AM to take the temperature of what they want the people to think as well as reports on general insanity.

WBCQ my favorite shortwave station.

When the power goes out that is how we will get our info and be able to communicate around the world. A good investment if you can do it.

Need a radio? Radioddity is a good place to shop. [Link]