The FTSE 100 company made underlying profits before interest and tax of £2.7bn on record sales of £25.3bn in 2023.

Shares in weapons manufacturers have surged in the past two years after Russia's full-scale invasion of Ukraine in February 2022 made governments reassess their plans for military spending.

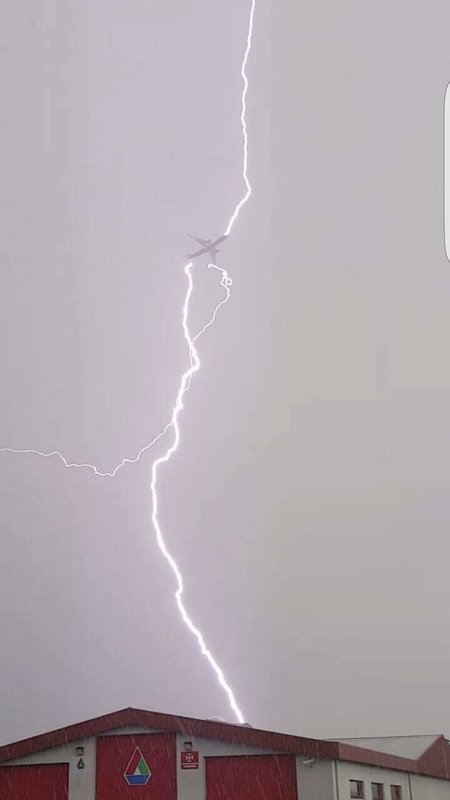

Comment: A variety of 'mishaps' highlight that, despite spending record sums, competence is plummeting: British nuclear submarine missile MISFIRES and 'plops' into the ocean, 2nd such incident amid a myriad of other Navy fails

There have also been increased tensions across the Middle East since 7 October, when Hamas, which runs Gaza, killed 1,139 people in an assault on Israel. Israel has responded with months of bombardment of Gaza, killing nearly 30,000 Palestinians.

BAE Systems' sprawling interests include building nuclear submarines and fighter jets, tanks and ships, as well as guns and ammunition.

Charles Woodburn, the BAE chief executive, said the weapons manufacturer was expecting "sustained growth in the coming years".

"Instability in Europe, the Middle East and other parts of the world brings into sharp focus the vital role that we play in protecting national security," he told reporters on Wednesday.

Comment: Not quite, because, unlike countries like Russia, the profit motive (in addition to pathology) compels these private companies to prefer war over peace.

"While most of our order volume was driven by existing programme positions that predate the Ukraine conflict, orders to restock and upgrade heavy armour and munitions are starting to come through."

Jarek Pominkiewicz, an equity research analyst at Quilter Cheviot, said BAE would benefit from a "growing recognition of the need to bolster defence spending", particularly in eastern European and Baltic countries close to Russia's borders.

BAE's share price dropped by more than 3% on Wednesday morning because margins were slightly lower than expected, but remain close to record highs, valuing the company at almost £38bn. Its shares have more than doubled in value since February 2022.

BAE was formed in 1999 from the merger of Marconi Electronic Systems and British Aerospace, itself a union of defence companies including British Aircraft Corporation and Hawker Siddeley.

It said it expected sales to rise by between 10% and 12% during 2024. Its long-term order book was also boosted last year by the Aukus pact between Australia, the UK and the US to build the next generation of nuclear-powered attack submarines, and the global combat air programme between Italy, Japan and the UK to develop a new fighter jet.

BAE said that the war in Ukraine in particular had highlighted the importance of autonomous technology, while "reinforcing the critical need for munitions and maintaining legacy capabilities".

Woodburn also said the company was "very happy with our London listing". Several of the biggest companies listed on London's stock market have moved to the US because of concerns that UK companies are relatively undervalued.

Comment: Or it's perhaps a sign of the hegemon eating its children: The London stock market's decline is starting to look terminal - The Telegraph

BAE Systems is unlikely to follow their lead because of the deep influence - including a "golden share" - that the UK government holds to prevent it falling into foreign ownership.

Woodburn said: "If you go back a few years, I think we were trading at a discount to some of our US peers, but I think through the strong performance of the business over recent years, I think we've, in many ways, closed much of that gap."

Comment: And the UK's energy suppliers and supermarkets are also reporting record profits; it's rather telling as to the warped state of the Western world that, as the suffering of people increases, so do the profits of mega-corporations: UK food shortages 'alarmingly likely' next year, University of Belfast warns - malnutrition cases tripled in 10 years

Despite the hype, the more rapacious the West becomes, the more glaring its failings: Russian arms production has Europe's warmongers worried