OF THE

TIMES

Chris Wray might have added ... "There is every chance that it could even be the same people from ISIS-K ... concert attack in Russia carrying out...

"Thuc Dho is a name created to represent a typical one." - That's not the only thing that was 'created' in this story. I flew Hueys on my first...

This parasite needs to be careful when he goes back out into the world because some people in Blighty ain't so forgiving. He could end up dead...

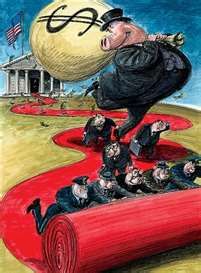

Unaware that they abandon future prospects for a short-term gain. Or, to quote the famous Mr. Ulyanov : The capitalists will sell us the rope with...

Warsaw wants to host NATO arms under the bloc's sharing scheme. Who is that „Warsaw”? All the Warsaw's inhabitants, maybe? Really? Or perhaps...

To submit an article for publication, see our Submission Guidelines

Reader comments do not necessarily reflect the views of the volunteers, editors, and directors of SOTT.net or the Quantum Future Group.

Some icons on this site were created by: Afterglow, Aha-Soft, AntialiasFactory, artdesigner.lv, Artura, DailyOverview, Everaldo, GraphicsFuel, IconFactory, Iconka, IconShock, Icons-Land, i-love-icons, KDE-look.org, Klukeart, mugenb16, Map Icons Collection, PetshopBoxStudio, VisualPharm, wbeiruti, WebIconset

Powered by PikaJS 🐁 and In·Site

Original content © 2002-2024 by Sott.net/Signs of the Times. See: FAIR USE NOTICE

Reader Comments

to our Newsletter