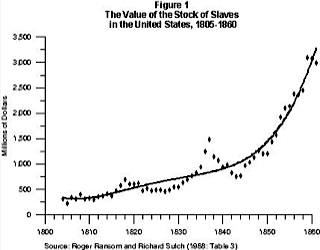

A little over a year ago, while researching the Confederacy's economy, I stumbled across this unnerving graph charting the value of America's "stock of slaves" in the last decades before the Civil War.

This graph tells the real story behind the South's secession: the value of the South's "slave stock" - the property of the ruling class - soared as secession approached, reaching an almost 90-degree angle in those final years before Harper's Ferry. The South's ruling class seceded to protect their riches, period.

From afar, if you didn't know that human "slave stock" was the asset being charted, you could easily mistake this graph, and its parabolic trajectory, for one of the many destructive asset bubbles this country has suffered right up through our own time.

Up close, this graph drips greed, mass murder and shame - it strips away the historical revisionism that falsely ascribed the South's "cause" to an almost selfless, tragically romantic attachment to "tradition" and "culture"; it gives lie to the myth that slave owners kept their slaves to the detriment of their own bottom line.

Like the worst wars and the worst of history's villains, the Confederacy's one percenters seceded and fought in order to continue profiting from their most valuable investment properties - their human slave stock.

The graph comes from a grim working paper, "Capitalists Without Capital," written in the late 1980s by a UC Berkeley economist, Richard Sutch, and a UC Riverside historian, Robert Ransom.

As they showed, slavery produced huge profits for southerners who invested in slave capital - to the detriment of all other portfolio investments, as the value of slaves soared in the mid-19th century. By that time, by far the largest cotton-growing states' wealth was in slave stock, not in real estate or other investments.

The slave trade was outlawed in 1808; but the slave population quadrupled from 1 million in 1800 to 4 million in 1860 - encouraged by slaveowners who "bred" their human stock, thereby multiplying their profits as the value of each slave rose.

Slavery is often portrayed by revisionist historians as somehow antithetical to market capitalism; in reality, slavery was a winning portfolio investment, the very incarnation of just how evil "free-market" capitalism can be. As the authors write:

"If slaves ... were an investment included in the asset portfolio of the planter/entrepreneur, they helped satisfy the owner's demand for wealth. But unlike most other forms of capital, which depreciate with time, the stock of slaves appreciated. Thus, the growth of the slave population continuously increased the stock of wealth."What makes this graph so disturbing for us in 2012 is what it suggests about today's "1 percent" - and how they view the rest of us. It gives form to the brutal crackdown on the Occupy protests - and suggests darker things to come as we try to free ourselves from their vision of civilization, and our place in it.

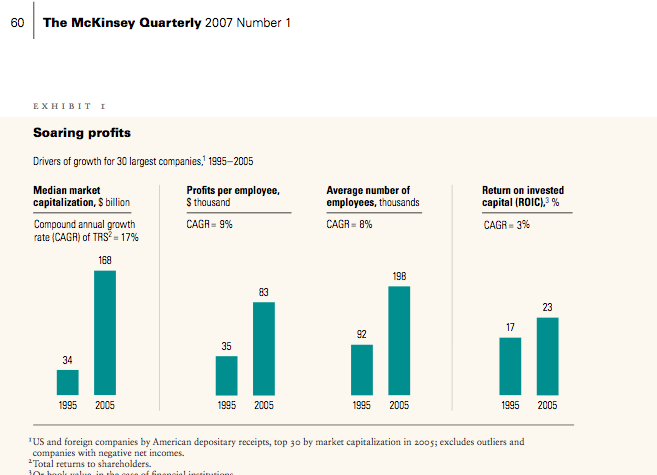

Contrast that with this McKinsey report put out a few years ago by the director of the consulting group's New York office. Titled "The New Metrics of Corporate Performance: Profit Per Employee," the report argues that the best performing firms in our increasingly financialized era are those companies that have learned to squeeze ever-larger profits out of each employee - and not by the more traditional "return on investment" metric.

The McKinsey report looked at the world's 30 largest companies between 1995 and 2005, and found that their return on human capital more than doubled, from an average of $35,000 profit per employee to $83,000, leading to this rather frank and nauseating conclusion:

"If a company's capital intensity doesn't increase, profit per employee is a pretty good proxy for the return on intangibles. The hallmark of financial performance in today's digital age is an expanded ability to earn 'rents' from intangibles. Profit per employee is one measure of those rents. If a company boosts its profit per employee without increasing its capital intensity, management will increase its rents."Extracting rent from "employees" as a business strategy: This is supposed to be the language of feudalism, not modern advanced capitalism - and yet this is the cutting edge in 21st century capitalist thinking, unashamed and unvarnished:

"One way to improve a company's profit per employee is simply to shed low-profit employees. But if they generate profit greater than the cost of the capital used to support their work, shedding them actually reduces the creation of wealth."As with slave stock in a Southern investor's portfolio, the McKinsey report argues that as a corporation learns to successfully extract rent from its employees, the more employees it extracts rent from, the greater its aggregate profits.

To compare "the 99 percent" to African slaves would be crude; but the mindset of "the 1 percent" then, as now, is eerily consistent. They view the rest of us not as human beings with rights, but as livestock whose meat is "rent" to be extracted.

This is the language of plutocratic capitalism, a brutal system totally incompatible with democracy and antithetical to republican government and civilization. It is the language of misery, and misery is what "the 1 percent" is promising "the 99 percent" for years to come, in ever-greater doses.

Mark Ames is editor of The eXiled Online and author of the book Going Postal: Rage, Murder and Rebellion from Reagan's Workplaces to Clinton's Columbine and co-author with Matt Taibbi of The eXile: Sex, Drugs and Libel in the New Russia.

Andrew Jackson faced down secession fever in 1833. South Carolina had demanded to collect tariffs at the port of Charleston, and threatened to secede if they could not. By the numbers, the fact is, the South was being taxed at a rate four times greater than the North! Resentment was already strong by the late 1820's.

South Carolina also threatened to protect herself by raising her own army against the United States. Jackson considered this an act of insurrection bordering on treason and promised to raise an army four times bigger. South Carolina gave in. His Force Bill of 1833 legalized the use of US military to collect tariffs if necessary.

By the time the crisis settled down, it was evident that the South would not be satisfied with anything less than a separate southern Confederacy in which slavery would be a prominent part.