OF THE

TIMES

" Comment: Encouraging news, but it could be a feint. The same regulations on censorship and centralization of power could still be brought in...

At the end of the day - may the best ideas prevail. The chips are on the table. Place your bets!

Excellent SOTT comment.

Quote: "You gotta include the media, think tanks, and academia in this — in addition to the military-industrial complex and the political class....

Cynthia Chung is one of the best journalist/historians at revealing the dark underbelly of USA created wars to subjugate countries, murder the...

To submit an article for publication, see our Submission Guidelines

Reader comments do not necessarily reflect the views of the volunteers, editors, and directors of SOTT.net or the Quantum Future Group.

Some icons on this site were created by: Afterglow, Aha-Soft, AntialiasFactory, artdesigner.lv, Artura, DailyOverview, Everaldo, GraphicsFuel, IconFactory, Iconka, IconShock, Icons-Land, i-love-icons, KDE-look.org, Klukeart, mugenb16, Map Icons Collection, PetshopBoxStudio, VisualPharm, wbeiruti, WebIconset

Powered by PikaJS 🐁 and In·Site

Original content © 2002-2024 by Sott.net/Signs of the Times. See: FAIR USE NOTICE

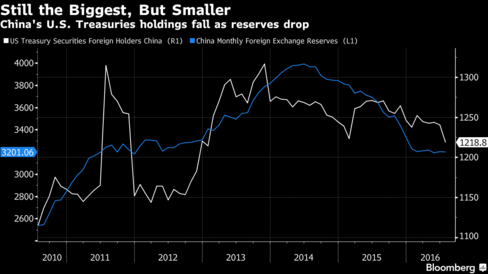

Comment: China's golden strategy to end the tyranny of the dollar