So much so, in fact, that the branch at 52nd St. and Park Avenue ran out of $100 bills according to the New York Times, citing three people familiar with the branch's operations. Of note, the problem was limited to large bills - with smaller denominations remaining stocked. Two days later, the bank was resupplied.

"We don't keep large amounts of cash in big bills in the branches because it's dangerous for our employees and there is low demand," said Bank of America spokesman Bill Halldin, who added that the bank had enough cash available to meet its clients' needs.The shortage hit after a rash of requests for as much as $50,000, said two people who witnessed the rush.

The problem was limited to large bills — the bank's A.T.M.s stayed stocked and customers with routine transactions were still able to take out cash. By Friday morning, the bank had refilled its supply of big bills, two of the people said.

But the desire for cash persisted: A teller at a JPMorgan Chase branch across the street said on Friday that there had been a "nonstop" stream of customers stockpiling cash over the past two days. -NYT

As the Times words it, "it appears the deep level of fear that has set in on Wall Street — as weeks of market gyrations have wiped trillions of dollars of wealth — has also permeated people's personal lives."

Notably, cash transportation company Brink's reported "a big spike in demand" last week from some of its bank clients according to company spokesman Edward Cunningham.

"They're putting more cash into branches, they're requesting more frequent replenishment of A.T.M.s," he said.

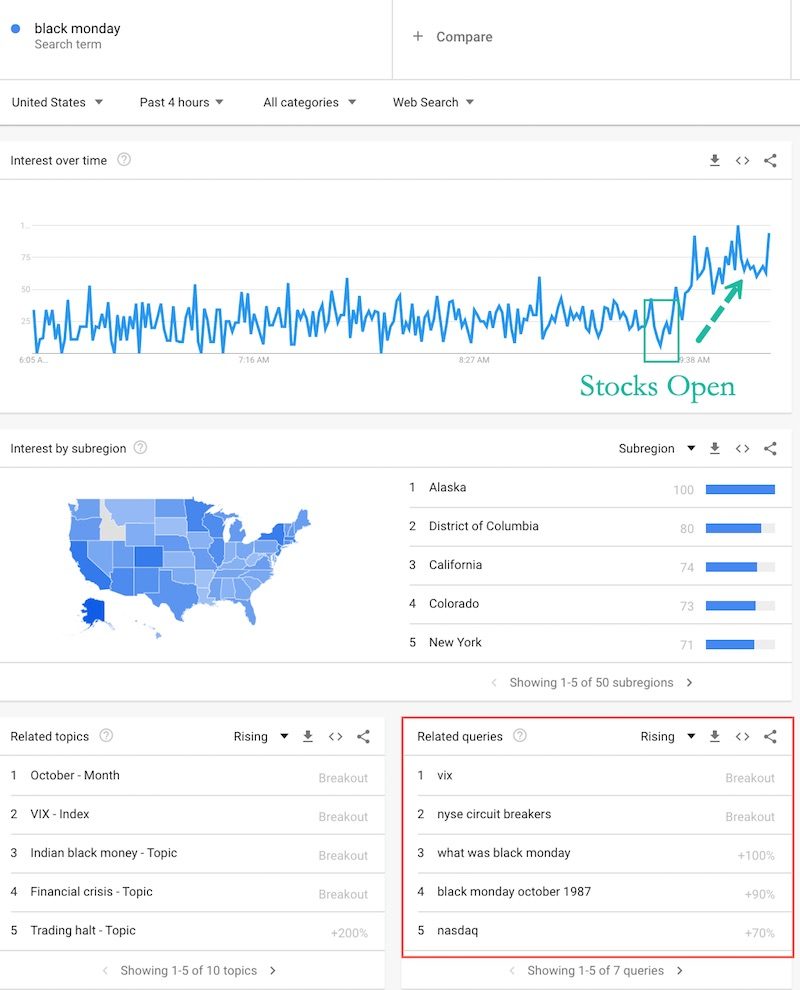

Panic began to set in last Monday after the S&P 500 triggered a "level one circuit breaker" following a drop of 7%. Google searches for "Black Monday" spiked, along with inquiries for "Vix," "NYSE circuit breakers," and "what was Black Monday."

The Fed, meanwhile, announced a $1.5 trillion repo intervention to try and calm the markets as the S&P 500 tumbled nearly 10% on Thursday - its worst day since the Black Monday crash of 1987. That said, markets were pleased after President Trump declared a national emergency which freed up billions in funding to fight the epidemic.

In short, it's no mystery why people facing a potential quarantine are pulling out large sums of cash.

Most people use far less cash than they did even a decade ago, as credit cards and other forms of digital payment have become the norm. Still, stacks of bills are psychologically reassuring, and are often what people, even the wealthiest, turn to in an unpredictable world.

The Park Avenue bank branches — just steps away from the headquarters of MetLife and BlackRock, the world's biggest investment management firm — draw an unusually affluent clientele. The typical American household has around $4,500 in its bank accounts, according to a SmartAsset analysis of the latest Federal Reserve data. -NYT

Comment: And for those who don't have stacks of bills at their disposal, toilet paper seems to do the trick:

Psychologists who study consumers in crisis explain it like this: Uncertainty around the virus drives us into panic mode, and we look for a way to stifle the anxiety that provokes.

We fixate on toilet paper not just for its utilitarian value, but also because accumulating an overload — imagine a tower of toilet paper packages in your garage — provides a reassuring visual cue: You're equipped for a long quarantine.

Still, banking industry officials say that the system has plenty of cash to deal with a surge in withdrawals. The Fed, meanwhile, says it hasn't experienced pronounced increases and has "had no difficulty meeting demand," according to a spokeswoman who added that the central bank has plans in place to address a range of contingencies.

To keep money on hand for banks, the Federal Reserve Bank of New York keeps billions of dollars in custody in an East Rutherford, NJ storage facility. It typically sees surges during holidays and long weekends which can send demand up by 20%. The facility has the capacity to more than double its shipment volume if needed, according to the Times, citing two people familiar with its operations.

So far, they say demand has been within fairly normal levels and is nowhere near the surges seen during disasters such as Hurricanes Maria and Sandy. After the 9/11 terror attacks, the supply of cash in circulation rose by $4 billion according to a study by the Federal Reserve Bank of Richmond.

Meanwhile, banks and trade groups have been working with officials from the Fed, government agencies, and the CDC to deal with the fallout from the coronavirus outbreak. Topics include how to handle a flood of mortgage refinancing applications as well as tips for disinfecting high-touch surfaces such as ATMs.

As for people stockpiling cash, Cunningham of Brink's said that the uptick in requests was so far limited to the largest banks, and may taper off as customers hole up in their homes.

"I don't know how long it will persist," he said. "It's kind of hard to predict what's going on right now."

Reader Comments