Russia inked a second blockbuster deal with China that will starve Europe for natural gas in just a few short years. It's now increasingly clear that 2018 will mark the beginning of the end for any hopes Europe had of returning to robust economic growth.

It was by far the biggest news of the day. While it did make headlines, you might have missed it because not much was made of the affair beyond the announcement. The story came and went as if Russia has oodles of natural gas (NG) to send to China.

It doesn't. And the supplies it has now contracted to send to China will be pulled from supplies that currently go to Europe.

For the people who understand global energy markets -- that energy is the one non-negotiable substance required for economic stability and growth -- this announcement was a huge deal.

Here's what was announced:

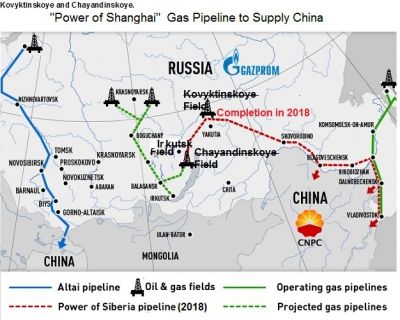

The basics of the story are very simple to follow. After backing a violent overthrow of the democratically-elected government of Ukraine back in February of 2014, the West, consisting of the US and Europe equally, chose to back the distastefully right-wing, oligarch regime that followed the downfall of former Ukrainian president Yanukovych.Moscow and Beijing signed an agreement to supply gas from western Siberia to China, in a deal that could eventually see more of Russia's gas flowing to its vast eastern neighbour than to its traditional European markets.

Assuming crucial details such as price are agreed, the deal would mark another big step in President Vladimir Putin's efforts to build a closer energy relationship with China to offset increasing isolation from the west.

It would see Gazprom, the Kremlin-controlled energy group, supply China's state oil company CNPC with 30bn cubic metres of gas per year. That would be on top of the 38bcm/y Russia agreed to sell China in a $400bn agreement signed in May.

Russia said nyet to that, and also did not like the breach of the prior agreement to not expand NATO "one inch to the east" made by James Baker in 1989. Russia knows all too well what happens when fascists arise on its western border, and they were not going to abandon the Russian speaking people in Crimea and the eastern provinces to the newly installed thugs in Kiev.

Somehow Russia's invoking of a final line-in-the-sand over Ukraine proved to be upsetting to the western powers, and they have waged an increasing crescendo of economic and diplomatic war against Russia ever since. And a propaganda war too we should add.

And it was personal, too. Those closest to Putin were specifically targeted, seeing their private bank accounts frozen, travel restricted, and deals scuttled.

Such tactics are indeed war by any other name. The funny part of it all, is that nobody can explain what the US' strategic interests the Ukraine even are, and therefore I have found no compelling rationale for alienating Russia, a major nuclear power. Lacking any reasonable explanation the only one left on the surface is that the US is angry that Russia does not simply allow the US to do whatever it wants, when it wants, and how it wants.

Comment: That is true partially because Putin has been smart enough to understand and block the US/NATO strategy which ultimately seeks to break ties between Russia and the EU, while plotting to dismember the Russian Federation. The end goal is to make the US the preeminent superpower and prevent any alternatives from emerging in Europe and Eurasia to counter the empire.

Even more puzzling is the position of Europe, which apparently values being a handmaiden of US petulance more than they value being warm in winter or having a robust economy. Because that's exactly what's at stake. And now, what we've been warning about since this all started, the critical loss of energy supplies from Russia, is coming to pass.

The most critical part of the above article is this next paragraph:

There it is. In black and white. Russia has inked a deal to send to China NG that used to flow to Europe. Interestingly, rather than just cutting Europe off Russia has chosen to go through the route of normal, capitalist, market mechanisms. Hey, this customer is offering me a better price, stability I can count on, and basic respect.The May deal involved gas from yet-to-be-developed fields in the remote tundra of eastern Siberia. However, the latest agreement, which is based on what Moscow refers to as the "western" route, would supply China with gas from fields in western Siberia that is currently piped to Europe.

I guess in a world where Japan is ruining its citizens future and the other central banks are conspiring on a daily basis to drive equity markets to brand new highs, such a momentous thing could get lost in the noise. But we're not going to let that happen.

This. Is. A. Very. Big. Deal.

Europe's gas has just been signed over to China. Well, some of it at least. But even a tiny bit at this point is a huge deal.

Even worse, the above paragraph soft-pedals the situation by stating that the prior deal inked in March of 2104 involved gas from "yet-to-be-developed" fields in eastern Siberia. But there's just one new field in that location coming on line, the Chayanda field, which is slated to begin production in 2015, and produce only 25 billion cubic meters (bcm) per year. China is expecting to receive 38 bcm per year on that prior deal -- so there's still some 13 bcm to account for.

Russian Production

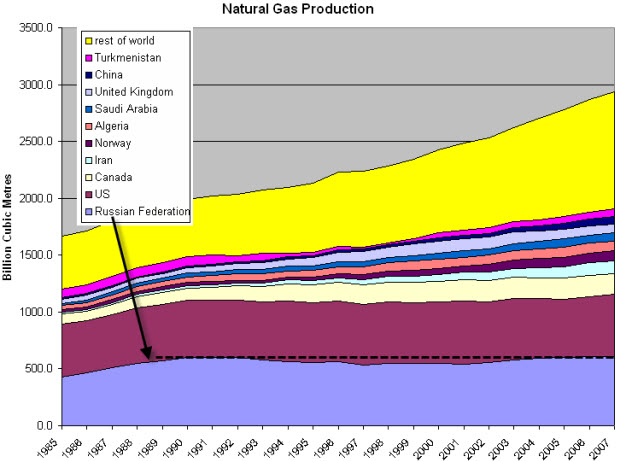

As we've noted before, NG production takes time to ramp up, is not all that amenable to rapid increases, and Russia has been fairly stable in terms of output over the past decades:

1989-2007 Russian natural gas output has been almost constant

Note that dotted line sitting at about 600 bcm has been there since 1990. China has just inked two deals that, taken together, account for 68 bcm of Russia's total output.

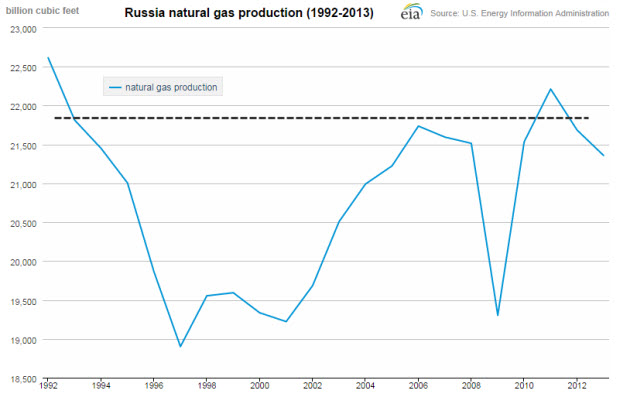

The above chart is just a little bit out of date, but the most recent data from the EIA says that nothing at all has changed in this story recently:

Gas output has not increased rapidly in recent years either

Again, the main issue here is that Europe is in a major bind.

Russia only has so much NG to sell. And they have decided to sell it to a different country than Europe (China), one that they suspect will be more likely to honor agreements and treat them well and rationally.

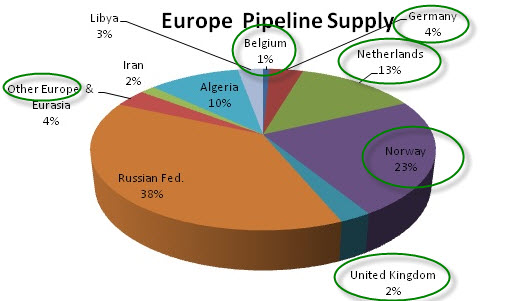

Europe is in a pickle now. Because not only are they about to lose a bit more than 25% of all their currently-imported NG from Russia, but their own domestic supplies are shrinking in concert.

Each green circle below represents a domestic source of NG that is shrinking for Europe:

Domestic European gas production is actually shrinking

The most critical of these is the Netherlands which is really just the Groningen field, which is way past prime and is being ramped down more quickly than originally expected. Why? Because it's creating earthquakes as the field subsides. The local citizens are none too keen about earthquakes for some reason.

So Europe is being squeezed now by falling production on one side, and falling imports on the other.

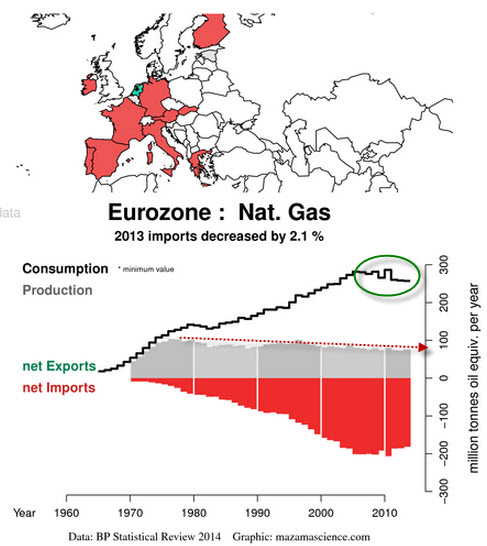

Seen at the macro scale, here's the situation in Europe:

Consumption is the black jagged line on top, production is the gray bars, and the deficit, which must be imported is in red below.

It's clear that production has been falling for many decades, and that the decline in consumption (green circle) was coincident with weak economic activity (not so coincidentally, by the way).

The point here is that Europe cannot have both less NG to burn and the robust economic growth it needs to dig out from under the staggering debt burden that the Euro-crats have taken on to combat weak growth.

No matter how you slice this, Europe is in big trouble. It will either have to fast-track new LNG terminals (very likely) or have to figure out how to struggle along with a 25% reduction in NG imports beginning in 2018.

For those with a mind for this, now is the time to invest in those companies that can bring lots of LNG to Europe.

Conclusion

So sorry for your loss there, Europeans. And don't expect the US to do anything tangible to help out, because there's nothing we can do. The US won't have any surplus NG to export until 2018 at the earliest, but the recent collapse in oil prices will certainly extend that date out a few years. So let's average it all out and call that 2020.

For my European readers, you still need to think long and hard about your personal exposure to this news.

The easy part to predict is that the cheap NG from Russia will be replaced by much more expensive NG from elsewhere, because that's the nature of LNG. It costs a lot.

The harder part to predict is what will happen as Europe's economy has to shoulder the burden of higher NG prices, let alone the possibility of NG shortages.

While we can all expect (or maybe just hope) that the Eurocrats will immediately recognize the seriousness of this news and fast-track new LNG terminals to handle the new volumes, there's always the chance that they won't. Europe moves a bit slower on some things - especially contentious things - and there's really nothing much more contentious than a new LNG terminal.

Reader Comments

They reap what they have sown, they have to lay in the bed they have made.

For the West, the sky will come crashing down. The fracking gas will dry up in concert with the re-routing of gas to China. Europe has shot itself in the foot over nothing more than dreams of grandeur whose days ran out. By association, the US will find it's friends waning in strength.