Careful to avoid upsetting his 'allies' across the pond, Sapin followed up with the slam-dunk diplomacy, "This is not a fight against dollar imperialism," except, of course - that's exactly what it is... just as it was over 40 years ago when the French challenged Nixon.

Nope - no anti-dollar-imperiliasm here at all...

Single whammy:

- NOYER: BNP CASE WILL ENCOURAGE 'DIVERSIFICATION' FROM DOLLAR

Q. Doesn't the role of the dollar as an international currency create systemic risk?

Noyer: Beyond [the BNP] case, increased legal risks from the application of U.S. rules to all dollar transactions around the world will encourage a diversification from the dollar. BNP Paribas was the occasion for many observers to remember that there has been a number of sanctions and that there would certainly be others in the future. A movement to diversify the currencies used in international trade is inevitable. Trade between Europe and China does not need to use the dollar and may be read and fully paid in euros or renminbi. Walking towards a multipolar world is the natural monetary policy, since there are several major economic and monetary powerful ensembles. China has decided to develop the renminbi as a settlement currency. The Bank of France was behind the popular ECB-PBOC swap and we have just concluded a memorandum on the creation of a system of offshore renminbi clearing in Paris. We have very strong cooperation with the PBOC in this field. But these changes take time. We must not forget that it took decades after the United States became the world's largest economy for the dollar to replace the British pound as the first international currency. But the phenomenon of U.S. rules expanding to all USD-denominated transactions around the world can have an accelerating effect.In other words, the head of the French central bank, and ECB member, Christian Noyer, just issued a direct threat to the world's reserve currency (for now), the US Dollar.

Double whammy:

- Total's de Margerie Sees No Need for Dollars in Oil Purchases

Oil major Total's chief executive Christophe de Margerie was responding to questions about calls by French policymakers to find ways at EU level to bolster the use of the euro in international business following a record U.S. fine for BNP.So even a major beneficiary of the status quo appears to see the end in sight for the Petrodollar.

"There is no reason to pay for oil in dollars," he said. He said the fact that oil prices are quoted in dollars per barrel did not mean that payments actually had to be made in that currency.

And now The Triple Whammy

- *FRANCE SAYS INCREASING EURO USE IS ISSUE OF 'GLOBAL BALANCE'

- *SAPIN SAYS EURO AREA NEEDS TO LEAD DISCUSSION ON DOLLAR USE

- *FRANCE NOT FIGHTING 'DOLLAR IMPERIALISM,' SAPIN SAYS (so why mention it?)

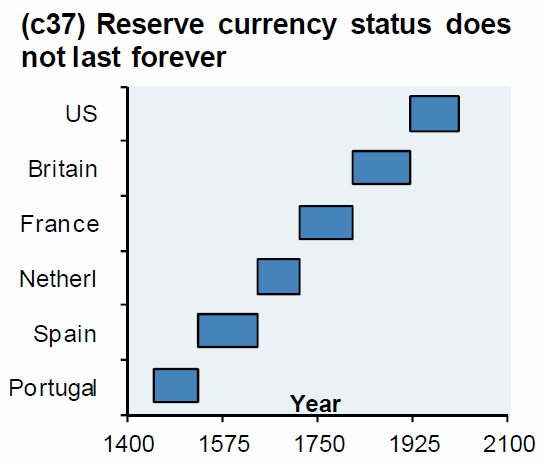

"We sell ourselves aircraft in dollars. Is that really necessary? I don't think so," Sapin says, adding "I think a rebalancing is possible and necessary, not just regarding the euro but also for the big currencies of the emerging countries, which account for more and more of global trade."As we showed only yesterday...(and have ever since 2010)... nothing lasts forever

"We can avoid the exchange rate risk, and that's always useful. We can diminish financing costs in pricing more in other currencies," Sapin says.

"This is not a fight against dollar imperialism," Sapin says.

"It's up to Europe, to the euro zone in particular, to lead this argument," Sapin says.

As The FT reports, Mr Sapin said he would raise the need for a weightier alternative to the dollar with fellow eurozone finance ministers when they meet in Brussels on Monday, although he declined to go into detail about what practical steps might emerge.

Comment: See also: