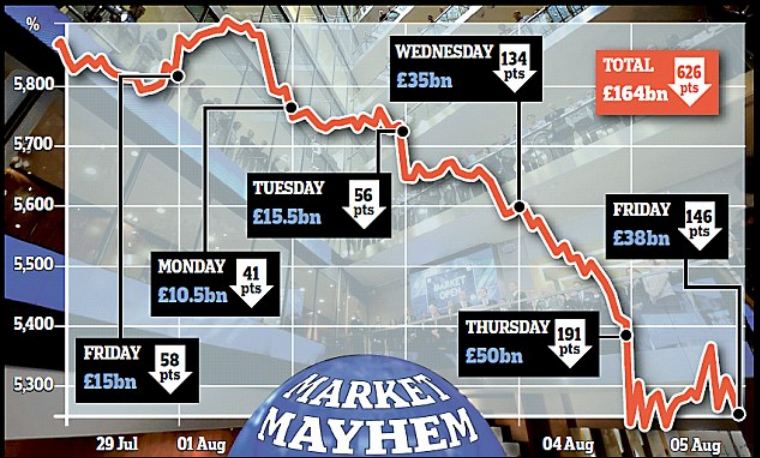

- £164bn wiped of British shares in a week

- Steel magnate Lakshmi Mittal loses £2.16bn

- Almost $3tn wiped off shares prices worldwide sparking fears of recession

The world's largest steel maker Lakshmi Mittal lost £2.16bn following a calamitous six days for stock markets on both sides of the Atlantic sparking fears the meltdown will lead to a double-dip recession.

The share price of Mr Mittal's company Arcelor Mittal, of which he owns 40.83 per cent, plummeted 18.7 per cent this week reducing the value of his fortune to £9.7bn.

The steel magnate, born into poverty in India, employs 320,000 people in 60 countries and lives in Bernie Ecclestone's former home in Kensington which he bought in 2004 for a reported £57million.

Meanwhile, commodities trader Ivan Glasenberg, who heads up Glencore International, also had a miserable week - although not as bad as Mr Mittal.

He lost £788m as his share price plummeted 13.2 per cent leaving his 15.8 per cent of the company worth £4.7bn.

Other victims of the slump were Mike Ashley, owner of Sports Direct International and Newcastle Football Club, who lost £203.4m, whilst easyJet entrepreneur Stelios Haji-Ioannou had £54m sliced off his fortune.

Carphone warehouse founder Charles Dunstone came in at fifth place losing £38.6m leaving his 29.1 per cent of the firm now worth £506.4m.

The FTSE 100 index lost more than 600 points in the past six days. The 11.14 per cent drop is the most punishing since the depths of the financial crisis three years ago, when it shed more than 1,000 points in a week.

Yesterday's drop was 2.7 per cent, less than Thursday's of 3.4 per cent.

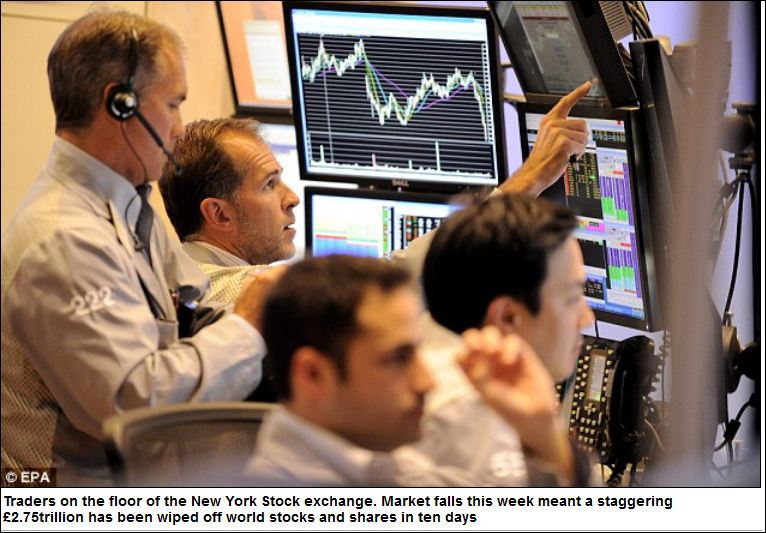

The market falls meant a staggering $2.75trillion has been wiped off world stocks and shares in ten days and has sparked fears of a new global recession.

Last night the U.S. lost its top-notch AAA credit rating, in a dramatic reversal of fortune for the world's largest economy.

The Standard & Poor's agency cut their rating down to AA-plus amid concerns about budget deficits.

About 40 per cent of Britain's trade is with the eurozone and our banks have hundreds of billions of pounds of exposure to European financial institutions.

The dire warnings were reinforced by former Labour Chancellor Alistair Darling who said he now expected a new recession. 'I have always thought that we won't get a double-dip recession here in the UK. If you asked me now, well it's on the cards.'

Ministers yesterday admitted the British economy was in peril amid the recession warnings.

The Treasury conceded that the Government's bid to sort out the public finances and create jobs could be blown off course by the crisis in the eurozone, which analysts branded the 'black death' of the world economy.

David Cameron and George Osborne broke off their holidays to demand action from EU leaders, warning that failure to prop up the single currency could drag the UK into the same depths of financial carnage.

Senior Government officials blamed the market meltdown on the failure of eurozone nations to go through with their planned bailout of Greece agreed just two weeks ago.

In a bleak assessment of the dangers to Britain, Treasury minister Justine Greening admitted the chances of turning round the economy are now in danger.

Yesterday a bigger than expected increase in job numbers in the United States lifted the gloom briefly but the respite was short-lived and shares dived into the red once again.

is apparently hard at work trying to characterize the uber-rich as victims of the debt debacle.

I guess they're hoping to keep the long-suffering rest of the world from thinking about their own suffering at the hands of these same rich ones.